While technically a technology company, Silex is shaping up to be an important player in the uranium and silicon space, developing laser enrichment technology for both chemical elements. They are currently aiming to build a commercial-scale pilot plant in a joint venture with uranium giant Cameco that, if successful, would allow the western world to become self-sufficient. The company raised $120m at $4.05/sh last month which was a ~13% discount to the share price at the time, with the raise now ~15% underwater and while the raise was opportunistic given shares had nearly doubled in just 3 months, the raise and subsequent share price pressure has created an opportunity. Much of the selling came for technical reasons, with Silex (SLX) expected to be added to a number of key indices ahead of the raise, hedge funds had been buying stock expecting to sell into index-tracking funds at the time of the inclusion, but were left cornered in the institutional placement, exacerbating the selling since. We like the technology and the company’s outlook with a number of near-term catalysts and a supportive global partner in Cameco.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

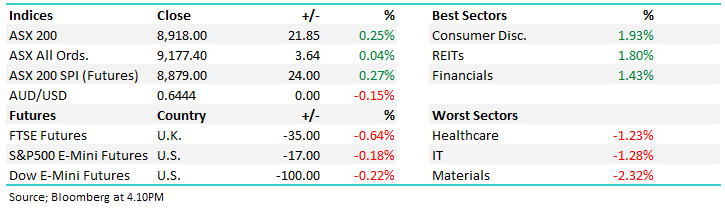

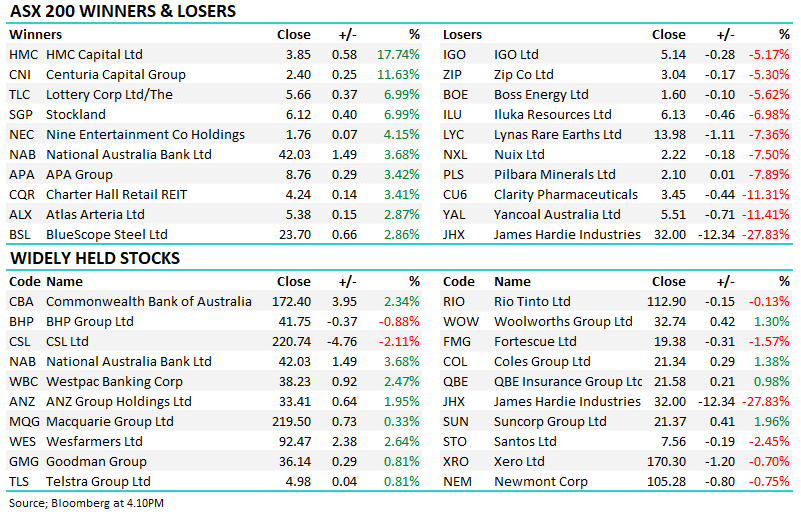

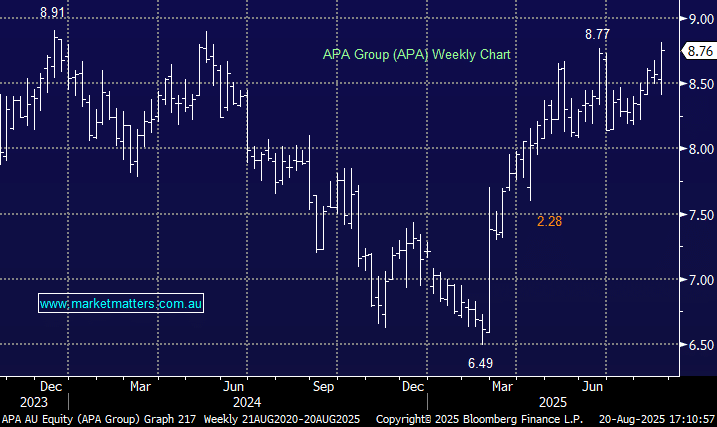

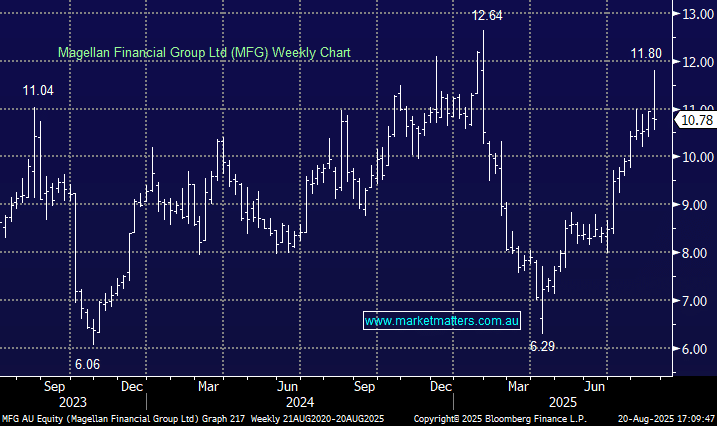

Wednesday 20th August – ASX +44pts, JHX, MFG, APA

Wednesday 20th August – ASX +44pts, JHX, MFG, APA

Close

Close

Wednesday 20th August – Dow up 10pts, SPI up +20pts

Wednesday 20th August – Dow up 10pts, SPI up +20pts

Close

Close

MM is bullish SLX, looking to add it to the Emerging Companies Portfolio

Add To Hit List

In these Portfolios

Related Q&A

Thoughts on SLX please

Update on FCL, FSLR, SLX and some lithium stocks

Can you explain your recent comments on uranium

Which Emerging Company does MM prefer SLX, RDY or SRG?

Thoughts on Silex Systems (SLX)

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Wednesday 20th August – ASX +44pts, JHX, MFG, APA

Daily Podcast Direct from the Desk

Podcast

LISTEN

Wednesday 20th August – Dow up 10pts, SPI up +20pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.