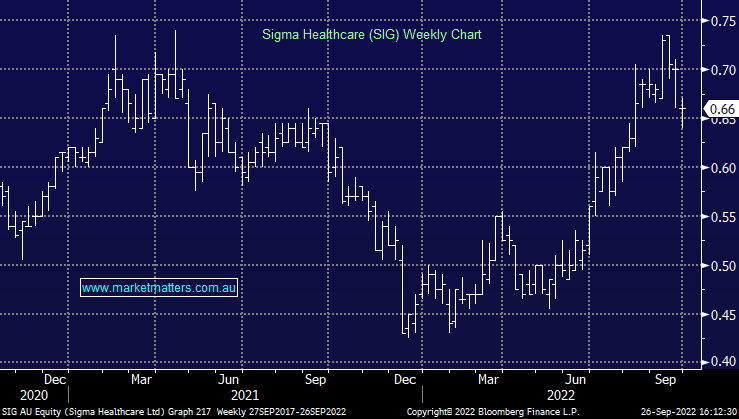

SIG -5.71%: first half results from the pharmaceutical product wholesaler was reasonable on the first read, however there are still a number of issues holding performance back. EBITDA was up 17% to $20.7m, while the company posted a net loss of $1.5m, though it included $38.7m worth of write-downs on assets and inventory. RAT sales continued to prop up the numbers, though a return to ‘normal’ has seen general pharmaceutical sales improve. The long standing issues with the company’s ERP software have been resolved and it is now up and running as designed. Costs have weighed on the numbers though with freight costs up 11% and employment costs up 13% including $3.3m increase in ongoing tech and support costs. Sigma didn’t give any firm guidance which further concerned the market, only talking to simplification and cost reduction.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is neutral/negative SIG ~66c

Add To Hit List

Related Q&A

Sigma Healthcare (SIG)

Question on SIG ( Sigma Health Care )

sigma/chemist warehouse reverse takeover

Thoughts on Sigma Healthcare (SIG)

sigma/ chemist warehouse reverse takeover

Sigma-Chemist Warehouse Merger

DMP & Chemist Warehouse

Sigma and Chemist Warehouse merger

What are MM’s thoughts on Sigma (SIG)?

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.