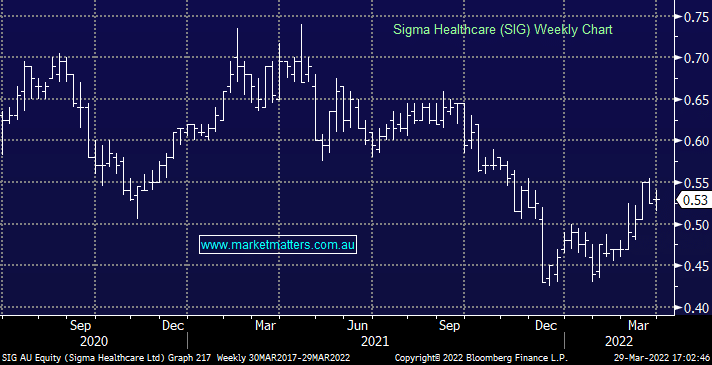

SIG +1.92%: Sigma is a chemist retailer operating under brands like Amcal and they also have a large wholesale business, although smaller than it once was after losing the contract to supply Chemist Warehouse a few years ago. They released FY22 results today and presented to us this afternoon. We haven’t really looked at SIG before and find it hard to get excited about the stock right now, although it is in turnaround mode. Today’s result was in line with both guidance and market expectations, FY22 underlying EBITDA of $92.1m was +10.8% on last year and compared to guidance of +10-15%. No FY23 guidance, but expects to return to profit in the period.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM has no real interest in SIG

Add To Hit List

Related Q&A

Sigma Healthcare (SIG)

Question on SIG ( Sigma Health Care )

sigma/chemist warehouse reverse takeover

Thoughts on Sigma Healthcare (SIG)

sigma/ chemist warehouse reverse takeover

Sigma-Chemist Warehouse Merger

DMP & Chemist Warehouse

Sigma and Chemist Warehouse merger

What are MM’s thoughts on Sigma (SIG)?

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.