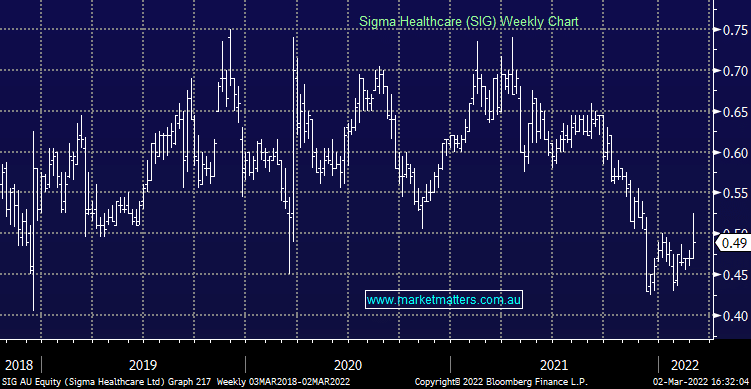

SIG -2%: surprisingly tough finish to the day for Sigma who substantially upgraded guidance for their FY22 result due out at the end of the month. The pharmaceutical wholesaler upgraded EBITDA guidance to 10-15% growth for the year against previous guidance of -10% as strong demand for COVID RATs helped turnaround performance into the January year end. Despite the big shift in guidance, the result will still be weighed on by further cost issues from the rollout of their ERP software designed to help pharmacies manage stock and workers. It does say a lot about the new system that it’s taken 4 weeks from the end of the financial year to notice a 20% swing in performance, and the upgrade is largely one-off given the nature of the demand for RATs.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is not excited about SIG ~50c

Add To Hit List

Related Q&A

Sigma Healthcare (SIG)

Question on SIG ( Sigma Health Care )

sigma/chemist warehouse reverse takeover

Thoughts on Sigma Healthcare (SIG)

sigma/ chemist warehouse reverse takeover

Sigma-Chemist Warehouse Merger

DMP & Chemist Warehouse

Sigma and Chemist Warehouse merger

What are MM’s thoughts on Sigma (SIG)?

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.