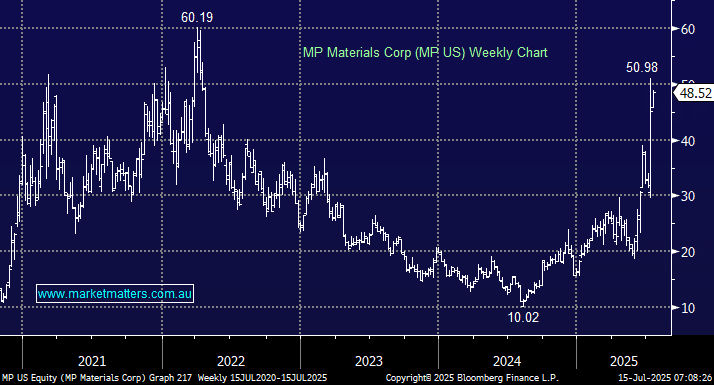

Last week the U.S. government, specifically the Department of Defense (DoD), took a 15% stake in MP Materials (MP US), the operator of the Mountain Pass rare earth mine in California. This move makes the DoD the largest single shareholder in the company and coincides with a massive investment package aimed at reshoring America’s rare-earth supply chain. The US is drawing a very firm line in the sand; any materials or knowledge that it’s at risk of finding itself in short supply &/or falling behind the rest of the world must be addressed now, from rare earths to copper, and AI. The move into MP, not surprisingly, sent the stocks soaring higher, with support likely into any dips.

- We like MP below $US50 believing its likely to trade through $US60 into 2026.

As we mentioned in a previous note, one of our initial thoughts was, what’s next with uranium supply, one of the obvious candidates, with the US being a significant supporter of nuclear power moving forward. We are currently very different in Australia, having no political interest in following much of the world into nuclear energy and Iluka (ILU) having to fight hard for government support to complete its Eneabba rare earths refinery. However, in 2024, the Labor government launched the $4 billion Critical Minerals Facility and provided tax incentives for processing and refining, although it hasn’t yet pulled too many levers on this front.

- We have revisited the rare earths sector today as it ” feels” like an optimum time to re-assess exposure.