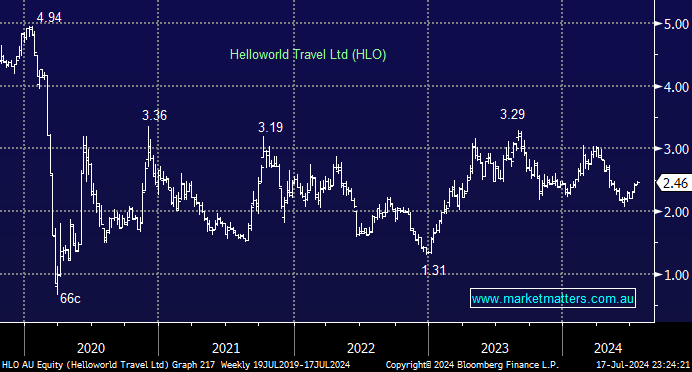

In yesterday’s Portfolio Positioning report, we covered $400mn HLO for our Emerging Companies Portfolio, adding the comparatively cheap travel agency to our Hitlist. As we said, recent strength in ABS travel data prompted MM to revisit HLO. This morning, we have cast the net further and updated our view on some of the majors in the Tourism Sector.

- ABS numbers for May showed a strong uptick in arrival and departure data, with arrivals up 14% from a year earlier and departures up nearly 15%, demonstrating the travel industry is in solid shape.

If MM is correct and the RBA follows other developed countries and pivots on interest rates through 2025, travel stocks are likely to embrace the improvement of discretionary spending, an area that has been under pressure from rising interest rates and inflation.

- As markets embrace a more dovish economic backdrop, we see HLO trading back towards $4; hence, it was elevated to our Hitlist on Wednesday, with the intention of buying at some stage.