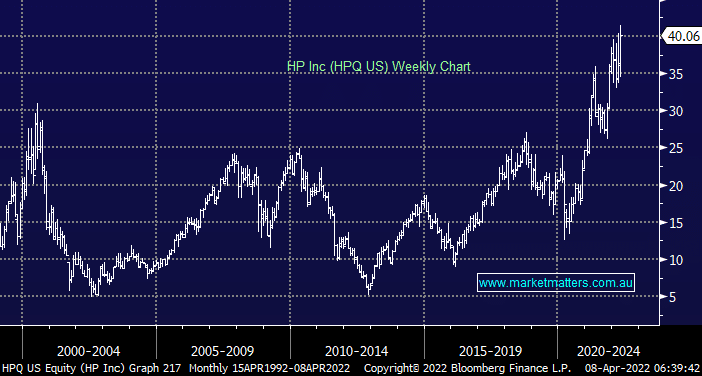

This week saw Warren Buffett’s Berkshire Hathaway reveal a $4.2bn investment in PC and printmaker HP making it the company’s 2nd largest tech holding after Apple Inc (AAPL US). The stocks certainly not trading at deep value as it made fresh highs following the news of the purchase but the company’s cycle now has it in a capital return phase with a low-single-digit growth profile i.e. far more up Buffett’s alley than a surging high valuation growth play. Some commentators are actually comparing it to the “Oracle of Omaha’s” poor investment in previous tech powerhouse IBM which has basically fallen for the last decade.

- Warren Buffett’s foray into HP Inc is not a classic high valuation growth play in the tech sector.

US big tech has corrected 22% as the world adjusts to a rising interest rate environment for the 1st time in over a decade, this is clearly not a great macro backdrop for high priced/growth names but we feel in general the risk/reward has become appealing for some stocks, especially in the short to medium term however when stocks fail to live up to expectations/valuations they are likely to be treated savagely e.g. Netflix (NFLX US) has more than halved from its December high. Hence we believe investors should acknowledge the risk profile that has evolved within the sector as all boats certainly will no longer rise as one!