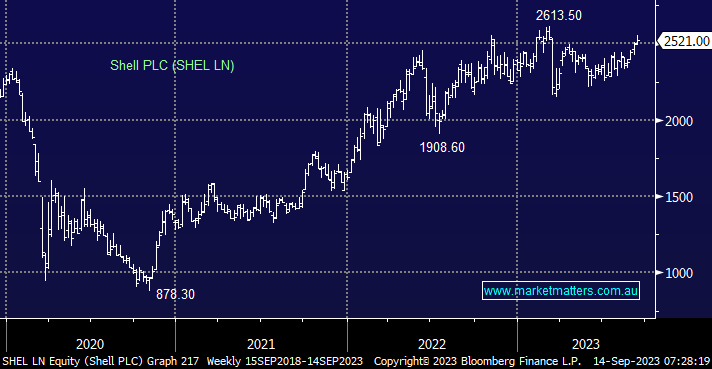

The picture from UK listed Shell is almost identical to that of XOM although its failed to break above its pre-COVID high of £2755, now around 8% away. Similar to XOM the UK giants profits both missed expectations and fell in the 2nd quarter although EBITDA of $US14.4bn still represents a very healthy business – a point of note being that its largest decline in profits came from its LNG operations.

- We are expecting SHEL to trade above its 2023 into Christmas but again, it’s not an advance we would chase.