Again, on the stock/ETF level, I am currently looking for ideas with no/little correlation to the ASX as a “risk-off” feeling creeps into the market. Last week’s moves across our positions was a testament to this outlook.

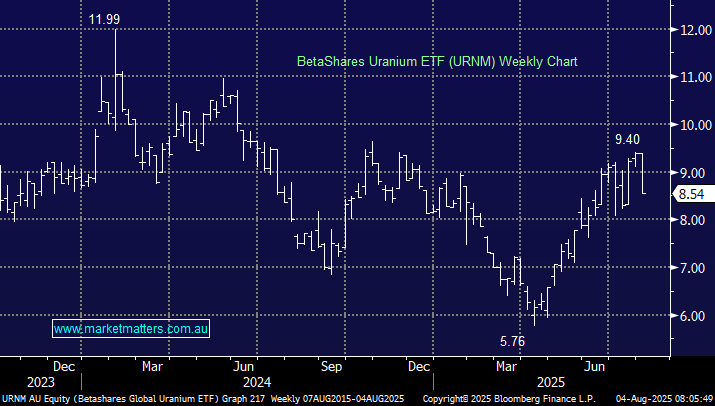

Last week, we were stopped out of Paladin (PDN), trying to gain exposure to the uranium narrative. This week, I’m adopting an if at first you don’t succeed, try, and try again approach, although I’m adopting a different vehicle. We are looking to leave a resting bid in the global uranium ETF (URNM), which only has 10-15% exposure to ASX uranium names.

- I believe the risk/reward towards the URNM ETF is attractive if we see a spike below $8 over the coming week.