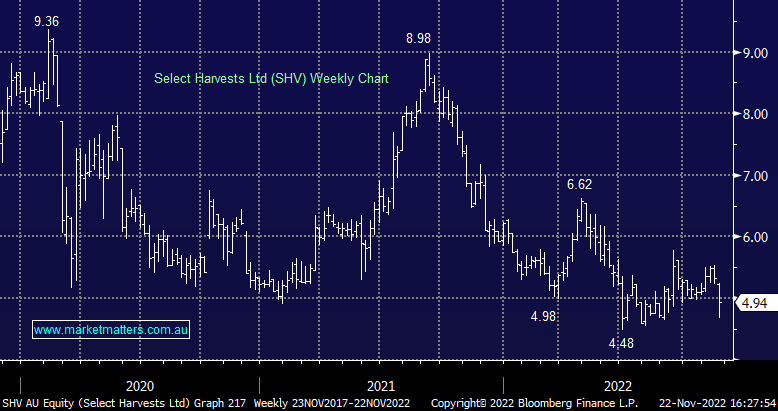

SHV -4.63%: the FY result was out today for the almond grower, with shares weaker on a slightly disappointing report. EBITDA was in line at $37.9m, however, the revenue of $200m and NPAT of $4.8m were slight misses to consensus. They produced 29kmt, right in the middle of guidance, while the selling price of $6.80/kg was slightly above expectations. The almond market remains oversupplied with prices at cyclical lows, however, there are signs the outlook is starting to improve as the drought in California weighs on crops, though this is taking longer than we expected to play out. Costs are also expected to be higher in FY23 given high fertilizer prices, though this is partially offset by lower water prices. The company said recent heavy rainfall across Australia is expected to have a minimal impact on the current crop.

scroll

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Friday 4th July – Dow up +344pts, SPI up +27pts

Friday 4th July – Dow up +344pts, SPI up +27pts

Close

Close

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Close

Close

Global X Battery Tech and Lithium ETF (ACDC)

Global X Battery Tech and Lithium ETF (ACDC)

Close

Close

MM is getting frustrated with our holding in SHV in the EC portfolio – so many moving parts!

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Friday 4th July – Dow up +344pts, SPI up +27pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Daily Podcast Direct from the Desk

chart

Global X Battery Tech and Lithium ETF (ACDC)

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.