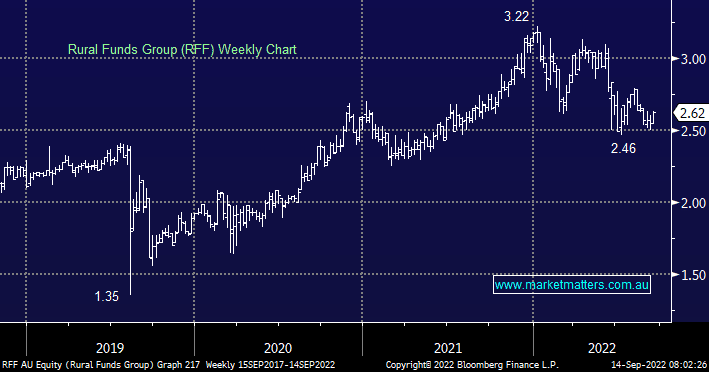

The ~$1bn real-estate property trust that owns Australian agricultural assets has been on our hit list for some time, and yesterday they announced a much-anticipated agreement to lease up to 3,000 hectares of central Queensland properties that will be used for macadamia orchards under a 40-year lease agreement with US asset management company The Rohatyn Group. The agreement is for an initial 1,200 hectares and a further 1,800 hectares of cropping and cattle land to be converted in FY24, subject to some conditions being met. The key terms of the agreement are solid and long-term in duration providing a high level of certainty to earnings for RFF which will support an unfranked yield of 4.5% in FY23 jumping to above 5% in outer years. While this would be a medium to long-term proposition, we like to buy these sorts of stocks into weakness which has been evident over the past 12 months, with the share price down 17%.

scroll

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM likes RFF as a medium/long-term investment ~$2.60

Add To Hit List

Related Q&A

APA , PLS , RFF

Rural Funds Group (RFF)

Why is Rural Funds Group (RFF) falling?

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.