RPL is a smaller $740mn Sydney-based fund manager that has shown an aggressive tilt towards growth, with FUM now sitting at ~$10bn. While we view the stock as reasonably expensive relative to their FUM, recent growth builds scale and diversification with a distinct skew towards alternative strategies. Phil King heads up the group and he is a deal maker, our view being that Phil is looking to get big, then get out.

We believe RPL has the potential to evolve strongly with plenty of growth opportunities moving forward, a forecasted 4% yield over the next 12-months helps the impatient investor, however this is not the reason to own RPL.

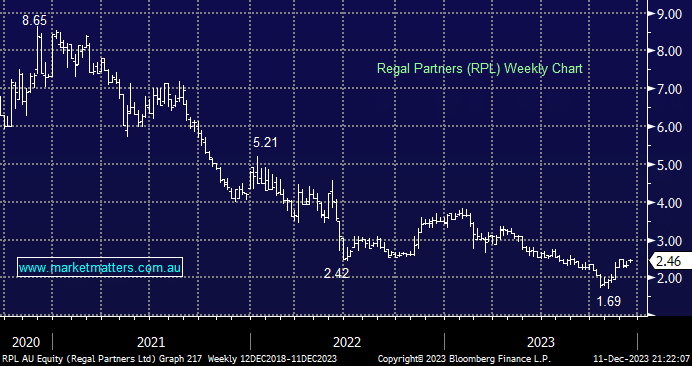

- We are long RPL in our Emerging Companies Portfolio, initially targeting the $3-3.50 area