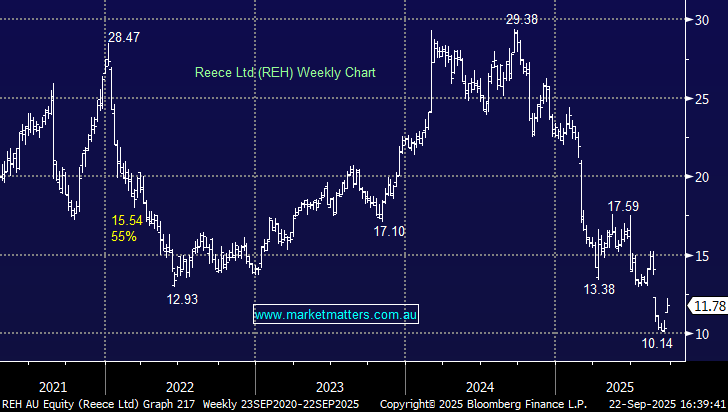

REH +14.15%: After a weaker than expected FY25 result just a month ago and shares down ~30% since, the plumbing business today announced a $250m off-market buyback with flexibility for up to $400m as part of its capital management strategy, finalising in October.

Shareholders will be able to tender their shares at a price range of between $11.00-$13.00 with the base level representing a 6.6% premium to the undisturbed last close of $10.32 or 26% to the top-end of the buyback range.

The buyback will provide an incremental boost to EPS and DPS, with the deal signaling management is relatively comfortable with the balance sheet – the share price should see support in the short-term though the market remains focused on improvement in their US segment which remains under pressure amid a stalled housing market.