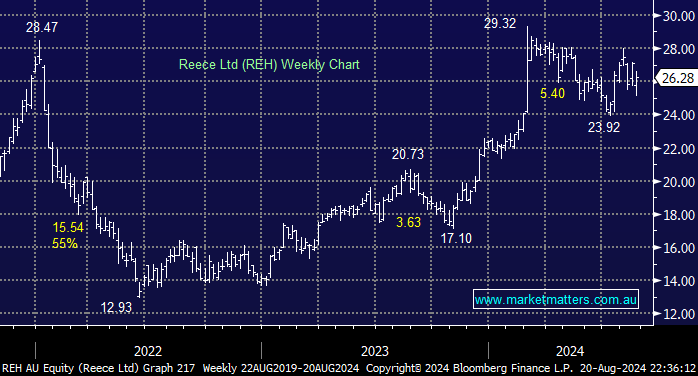

Plumbing, building and hardware merchant REH is unchanged so far this week after reporting on Monday. After the company narrowly missed analyst earnings estimates and flagged persistent short-term challenges, the stock initially dipped ~4% but has recovered as buying emerged into weakness.

- FY24 Adjusted EPS rose to 64c from 63c the year prior – expectations were closer to 65c.

- Sales revenue came in at $9.11bn, up 3% from $8.84bn – expectations were $8.6bn.

- A final dividend of 17.75c was announced, with a record date of October 9th and payable on October 23rd.

The company said near-term challenges are expected to remain in the US, Australia, and New Zealand regions. Over the longer term, however, the company’s fundamentals remain positive amid demand for housing and infrastructure. Following the release, analysts tweaked their estimates, including Goldman raising its PT by 2% to $23.70 while Cit cut its PT by 0.4% to $26.80. From a valuation perspective, little can be learned from REH, which has traded with a PE of up to 48.8x over the last five years and as low as 16.5x.

The key takeaways from REH’s 2H24 result for MM were as follows:

- FY24 revenue was good, and above expectations, however costs were higher, putting pressure on margins which led to a miss at the profit line.

- While margin pressure was obvious in FY24, this should ease with the 2H24 now reflecting wage increases and labour cost reduction strategies only in the early stages.

- The Australian business struggled for growth, and with costs elevated, remained a challenge.

- The USA’s growth strategy remains unchanged, with 10-15 new branches p.a. achievable. Given that this rollout remains a mix of M&A and organic additions, we expect a flat margin profile over the next 24 months.

- The Macro picture remains soft in FY25. REH is exposed to new construction in the USA, where near-term conditions remain challenging.

MM believes REH is a high-quality business that will grow its earnings in the medium term, but it’s hard to imagine outperformance until the local market shows meaningful improvement. While Reece continues to progress in its USA expansion, any benefits appear more than offset by a weakening Australian end market. Similar to our view on James Hardie (JHX), we think REH is more a FY26 story, than one for FY25, hence, we have removed REH from our Hitlist for now.

- We have removed Reece (REH) from our Hitlist, believing there are better opportunities elsewhere into Christmas.