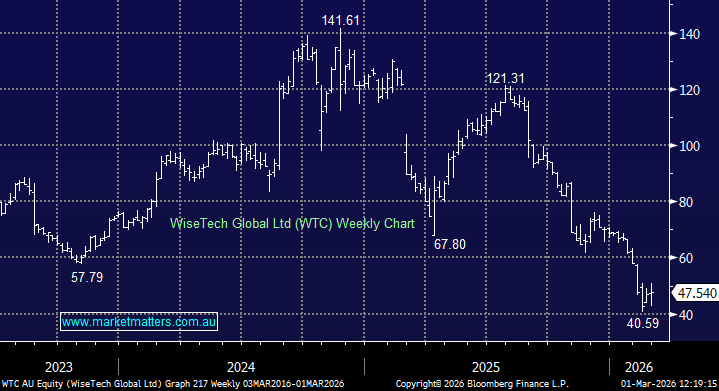

REH has fallen -44% so far in 2025 as the US construction industry struggles due to cost pressures from tariffs, elevated material prices, and a reluctance by homeowners to move, giving up lower interest rates that were locked in during the pandemic – not a great backdrop for REH, which generates well over half of its revenue from the US.

However, last month’s quarterly update was better than feared bringing into question how much negativity is built into the company’s valuation – its trading more than 30% below its average 5-year valuation and we’d argue that earnings estimates are low right now. That sets up the prospect for better earnings relative to consensus attracting a less discounted multiple. If that plays out, strong share price gains eventuate. They also have a $250m off-market buyback in play, with flexibility for up to $400m, which should help stabilise the stock.

Overall, we believe REH provides attractive exposure to a turnaround in the US construction market, with a management team more aligned with investors than some others (i.e. James Hardie).

- We believe REH is offering deep value and solid risk/reward at current levels.