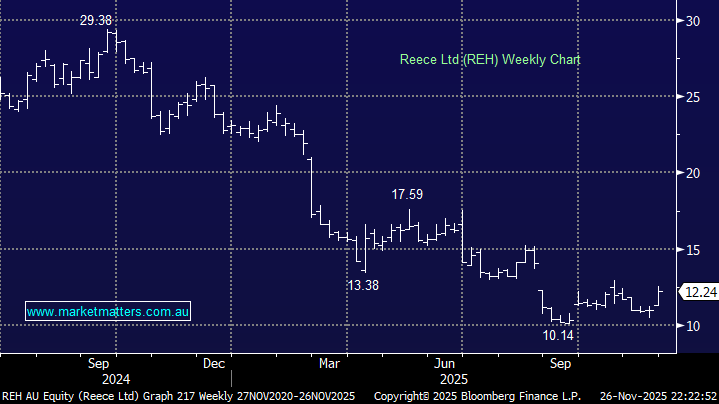

This week saw plumbing business REH deliver a 1Q26 trading update, which showed ‘less bad’ US sales than expected, important for a business that generated 57% of its FY25 revenue from the region. The sales beat should ease concerns about the company’s rollout strategy. Reece’s 15 new stores, including 10 in the U.S., helped drive 8% first-half sales growth across the group. The 2% like-for-like sales growth in Australia is weak (but improving), and this is not a stock priced for much growth at this juncture.

- They have a $250m off-market buyback in play, with flexibility for up to $400m, announced in September, which has also helped stabilise the stock around $11-12, and illustrates that management is comfortable with the company’s balance sheet.

From a takeover perspective, REH is trading on a depressed valuation at the bottom of the construction cycle, which would normally attract interest, particularly from more patient private-equity capital. However, the sticking point for Reece is the large stake held by the Wilson Family, who control over 50% of issued capital; We doubt they would be sellers of a cyclical business, probably, at or near cyclical lows.

We doubt REH is a serious takeover contender, but we do think it offers very interesting exposure to a turnaround in the US construction market, with a management team more aligned than some others (i.e James Hardie)

- We believe REH is offering deep value and solid risk/reward at current levels.