REA will announce its much-awaited half-year result early next month; we remain fans of this business, but not enough to chase it into strength ahead of its looming numbers. This real estate digital advertising business is another stock driven higher by momentum traders, which is a potentially dangerous/volatile situation, as we saw with Nvidia this week. Like much of the tech sector, REA is trading on a rich valuation compared to recent years, but nothing too scary/challenging. The business guided to double-digit growth in November, but the Australian residential housing market has started to soften, raising concerns about what its outlook statement will flag in February.

We shouldn’t forget that REA failed in its pursuit of Rightmove last year, the UK’s largest online real estate portal. The final bid, which was approximately £6.2 billion (around A$12 billion), was rejected, leading REA to abandon its takeover attempt – time will tell if they missed out or were lucky. After withdrawing from the bid, REA Group has been considering other growth opportunities, including potential acquisitions in offshore markets and investments in adjacent sectors. For instance, REA holds a nearly 20% stake in digital lender Athena and may focus more on the U.S. market, where it owns Move, the operator of realtor.com. Such expansion may necessitate a capital raise and better entry opportunities could present.

We like the business and sector and currently hold and remain bullish on Zillow (ZG US) in the US. It also looks poised to make fresh 3-year highs—we have ZG in our International Equities Portfolio. With the RBA set to commence cutting rates next month, the current softening property environment may prove short-lived and we will be comfortable buying the next dip in REA.

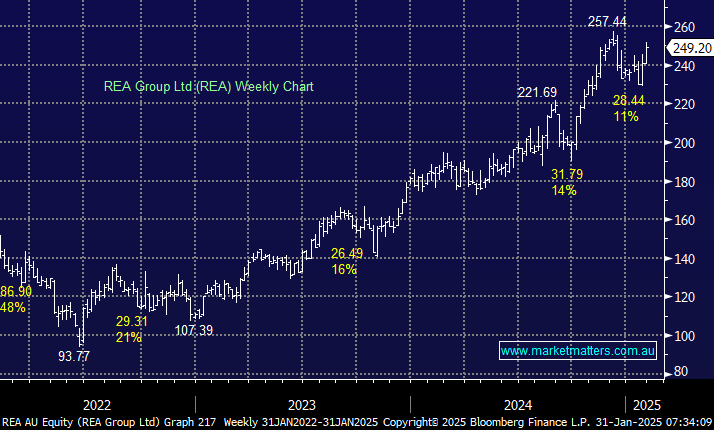

- We like REA and will be watching its next 10-15% pullback carefully. These generally unfold one to two times a year.