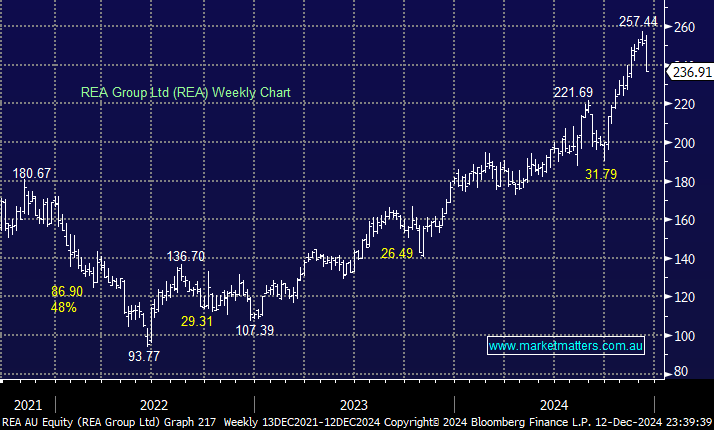

Real estate digital advertising business REA is another much-loved stock driven higher by momentum traders; history tells us that corrections can be sharp when the music stops playing in such circumstances. In a very similar fashion to CAR, this household name is trading on a very rich valuation from a historical perspective, i.e. it’s currently on 51.7x, having been as low as 33x in early 2023. The business guided to double-digit growth in November, but the Australian residential housing market has started to soften in some areas.

We discussed an entry point of sub-$190 in early September, but frustratingly, the share price has surged over 20% as investors have continued chasing popular stocks ever higher. Again, we like the business, but we’re not willing to pay up here and still prefer Zillow (ZG US) in the US even after its 50% pop higher – we have ZG in our International Equities Portfolio.

- Again, we are big fans of REA as a business, but it looks/feels “rich” around $237. Plus, it’s a volatile stock that isn’t unaccustomed to decent pullbacks, although we were too fussy a few months ago.