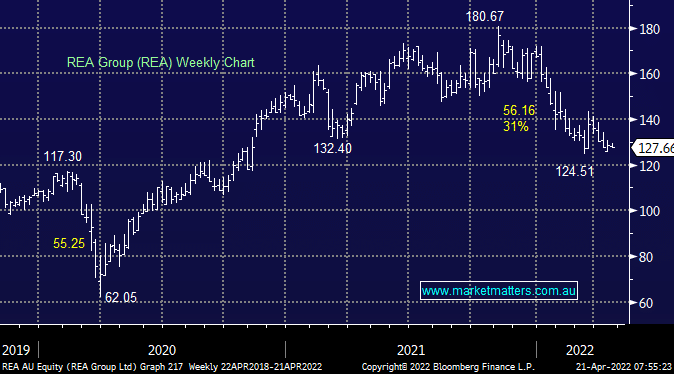

One of the qualities to look for in a defensive business is pricing power, and REA’s dominance in real-estate listings ensures it can raise prices regularly. When listing a house it’s almost a given that it will be posted on www.realestate.com.au in the first instance as part of a wider campaign. The stock has come under pressure as bond yields moved higher and concern around real-estate volumes intensified with the RBA poised to move from easy policy to tighter settings. With the stock down ~23% YTD, we think these fears are now overblown and view REA as an attractive, defensive stock now trading on the cheapest multiple since March 2020.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Friday 15th August – Dow off -11pts, SPI up +8pts

Friday 15th August – Dow off -11pts, SPI up +8pts

Close

Close

Thursday 14th August – ASX +66pts, WBC, TLS, PME

Thursday 14th August – ASX +66pts, WBC, TLS, PME

Close

Close

MM is now bullish REA below $130

Add To Hit List

Related Q&A

Thoughts on REA, CAR, & WES please

How should we handle the recent rally in SEK, AD8, HUB, REA & ALL?

What’s MM’s favourite 5 stocks for short term bull run?

Technical analysis of global indices please

Short term price targets for various stocks

Questions on CSL, REA & FMG

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Friday 15th August – Dow off -11pts, SPI up +8pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Thursday 14th August – ASX +66pts, WBC, TLS, PME

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.