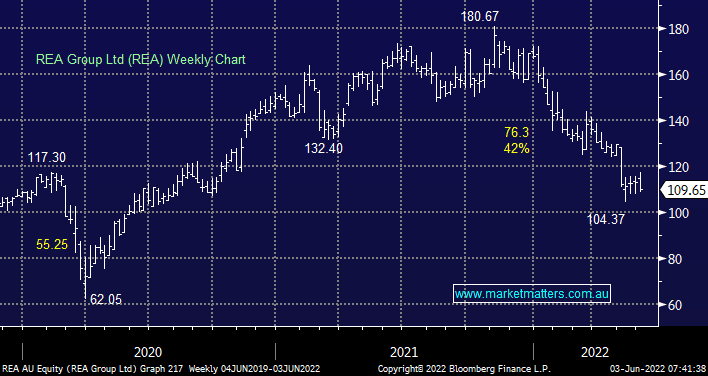

REA has corrected 42% from its mid-2021 high and is currently down 35% for the financial year after finding itself in two unpopular naughty corners i.e. property and high valuation growth names. This is a quality almost monopolistic style business with some useful pricing power but it currently is in the wrong place at the wrong time, the question is when has real value been restored – its still not cheap per se trading on a Est. valuation of 35.2x for 2022 but a little lower and it will become compelling although I would add that MM has no interest in increasing our tech exposure even though we anticipate a bounce from current levels.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Friday 15th August – Dow off -11pts, SPI up +8pts

Friday 15th August – Dow off -11pts, SPI up +8pts

Close

Close

Thursday 14th August – ASX +66pts, WBC, TLS, PME

Thursday 14th August – ASX +66pts, WBC, TLS, PME

Close

Close

MM likes REA into weakness under $100

Add To Hit List

Related Q&A

Thoughts on REA, CAR, & WES please

How should we handle the recent rally in SEK, AD8, HUB, REA & ALL?

What’s MM’s favourite 5 stocks for short term bull run?

Technical analysis of global indices please

Short term price targets for various stocks

Questions on CSL, REA & FMG

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Friday 15th August – Dow off -11pts, SPI up +8pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Thursday 14th August – ASX +66pts, WBC, TLS, PME

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.