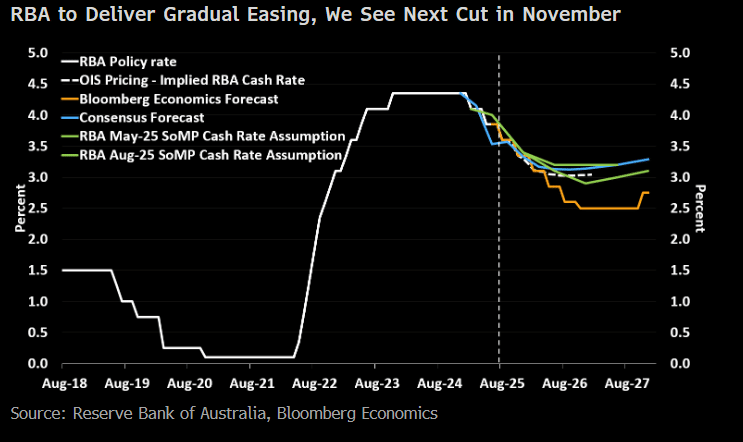

The RBA cut rates today by 0.25% as expected and perhaps more importantly, they also downgraded their growth outlook. They also highlighted their concerns for a further pullback in demand, opening the door for additional easing.

- The decision was unanimous across the 9-member board

- The central bank’s commentary was incrementally more dovish, pushing through downgrades to key growth assumptions.

- They also extended its inflation outlook by a further 6 months to the fourth quarter of 2027, and now sees the trimmed mean measure easing back to 2.5% year on year, down 0.1 percentage point from its 2Q27 end-point forecast of 2.6% in the May.

- Their own assumptions point to a further 70 bps of cuts by 4Q26. We think that’s still conservative against the backdrop of a softening economy, low inflation and rising unemployment.

We expect 70-100bps of further easing before next Christmas (2026), and assuming we get a gradual contraction in growth, and a mild uplift in unemployment, rather than something more sinister, this is a very good backdrop for asset prices generally.