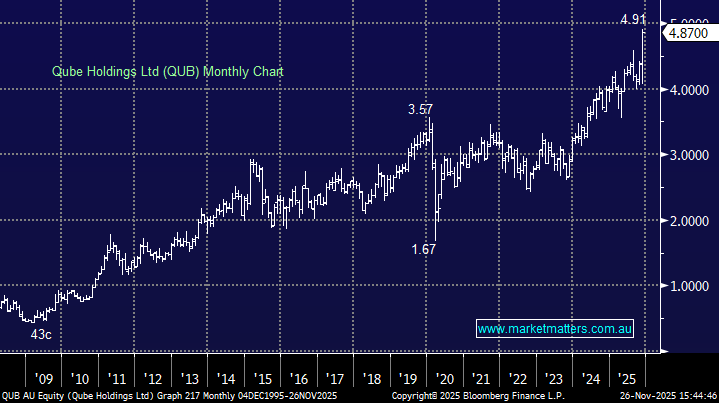

On Monday (24th Nov), Macquarie Asset Management submitted an all-cash takeover proposal for Qube — offering $5.20 per share, valuing Qube at about $11.6 billion (enterprise value, including debt) – the price represented roughly a 28% premium over Qube’s share price prior to the bid, very similar to NSR. At this stage, Qube’s board has granted Macquarie exclusive due diligence rights as part of the process. Macquarie Asset Management (MAM) is a highly experienced buyer of infrastructure and logistics assets and has a track record of completing large privatisations.

- We believe this deal will in all probability succeed, though the stock is trading at a ~6% discount, pricing in some uncertainty.