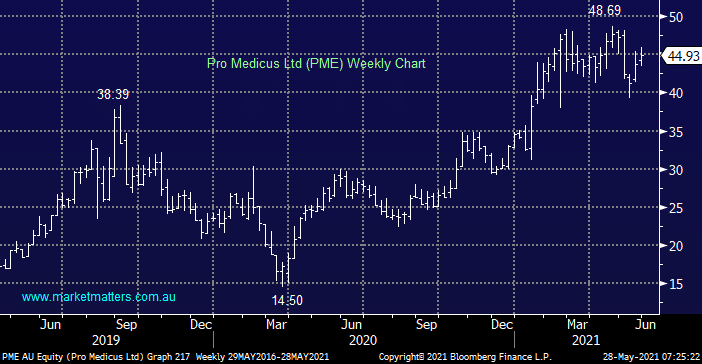

Imaging business PME has been a strong performer post COVID with its strong half-year result delivered in March confirming the business is kicking goals – revenue was up almost 8% to $31.6m while profit was just shy of $20m. We think PME is very likely to test $50 over the next 12-months but the risk / reward is only compelling under $40.

scroll

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM likes PME under $40

Add To Hit List

Related Q&A

Turnaround Opportunities

Xero (XRO), Wisetech (WTC), Pro Medicus (PME), and ANZ Bank (ANZ)

PME results / portfolio weightings

Does MM like Pro Medicus (PME) at current levels?

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.