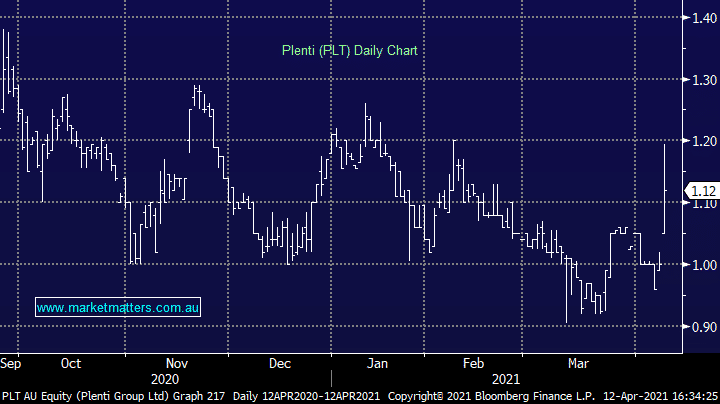

PLT +12%: The consumer lending business Plenti announced record quarterly numbers for the first 3 months of the year. With $172.4m loan originations in the quarter, it topped 120% growth on 2Q20, and 32% better than the 2 quarter of the year. Around half of the companies originations fall in auto lending, while around a third is personal and the remainder lending against renewable purchases such a solar panels. 90+ day losses fell marginally in the period, down to a slim 0.31%, largely thanks to continued stimulus supporting borrowers. The update provides a good read through for Wizr (WZR) which we hold in the Emerging Companies portfolio. Wizr has been outperforming peers Plenti (PLT) and Harmony (HMY) over the last few months though performance of the smaller lenders has been weak against a strong market. The space continues to see a structural tailwind with consumers looking outside of the big banks for their credit.

scroll

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM prefers WZR over PLT though is bullish on the sector

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.