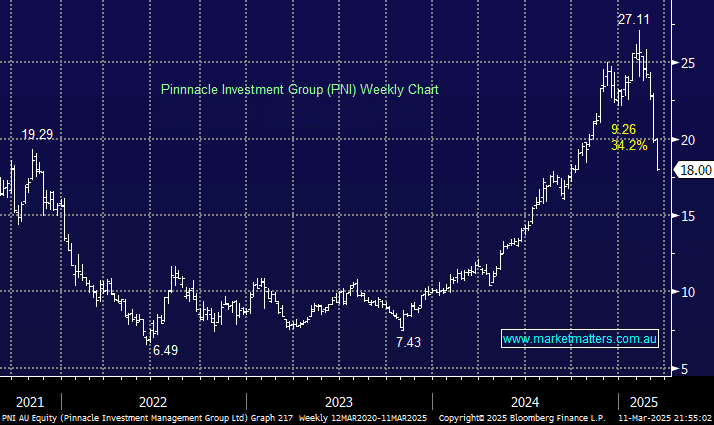

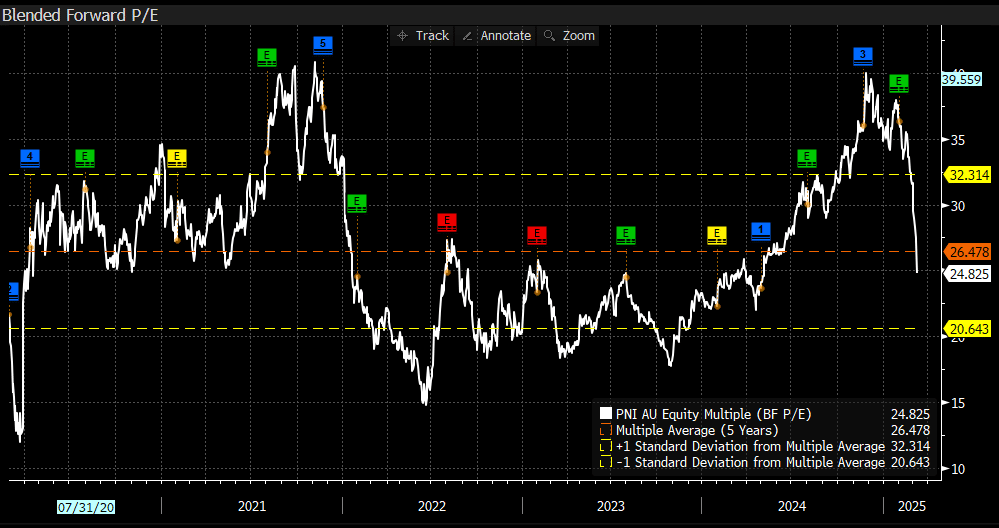

Market turmoil creates opportunity, and we’re seeing some significant moves in previously hot stocks, with PNI being a clear example. The re-rate lower has been aggressive, with the share price down more than 34% in just six chaotic weeks. This has restored value in PNI and we now add the stock to our Emerging Companies Hitlist.

As a quick refresher, PNI is a fund management group that helps independent boutique managers grow by providing operational, distribution, and strategic support. It earns revenue through fees from the management of funds and by investing in its boutique partners. In the early days, PNI was very focused on equity managers, so they had significant exposure to the ebbs and flows of the equity market.

In early 2020, PNI had $53 billion in funds under management via minority stakes in just over a dozen asset managers, including brands like Hyperion, Plato, Resolution Capital, Antipodes and Metrics. Today, that number sits at over $155 billion across 18 managers, diversified across asset classes and geographical locations, providing a significantly more robust operation.

- As MM consistently reminds readers, volatility creates opportunities, and we think the pullback in PNI shares is a clear example