PNI is a fund management group that helps independent boutique managers grow with revenue generated through fees from the management of funds and by investing in their boutique partners. PNI has evolved its business from being very focused on equity managers with earnings being vulnerable to market swings. Around COVID, PNI had $53 billion in funds under management via minority stakes in just over a dozen asset managers, including brands like Hyperion, Plato, Resolution Capital, Antipodes and Metrics. Today, that number sits at over $155 billion across 18 managers, diversified across asset classes and geographical locations, providing a significantly more robust operation.

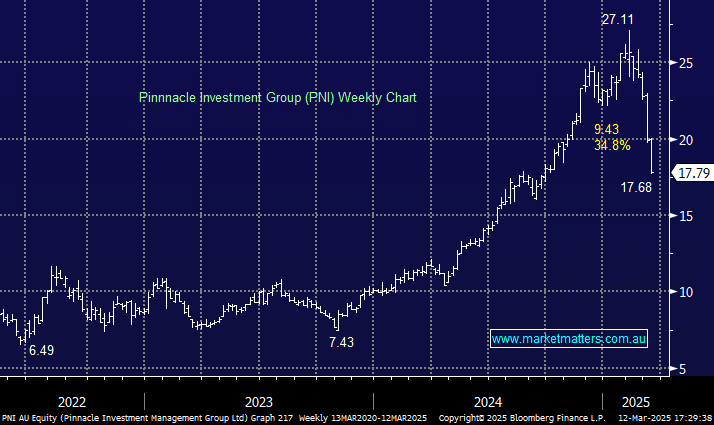

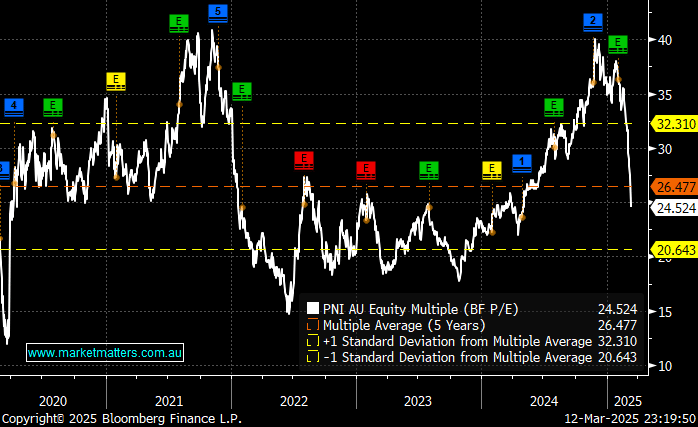

However, PNI has still been thumped by ~35% during recent market turmoil – it remains a “High Beta” play on panic. At MM, we believe this re-rating is overdone. With the stock’s valuation finally dipping into the “cheap” area, the panic selling has not taken into account the company’s evolution over recent years, which brings with it opportunity.

The downside momentum in several crowded stocks is poor, but we believe the stock’s current entry levels will look good in the coming months/years.

- We are bullish on PNI. We bought the stock on Wednesday for our Emerging Companies Portfolio, putting our money where our mouth is.