PEXA is an electronic lodgement and settlement network that aligns communication in property transactions between vendors, banks, lawyers and other participants in the transaction. It is a growth company, on a growth multiple/valuation, but has ultimately failed to meet market expectations. It was originally formed by what is now known as the National Cabinet, funded by the big 4 banks, with Link Administration (LNK) also providing capital in later rounds before its IPO in 2021. There was a growing push from all stakeholders to use a platform in property settlements and refinancing and PXA was born to solve the problem, and they’ve been successful in doing so.

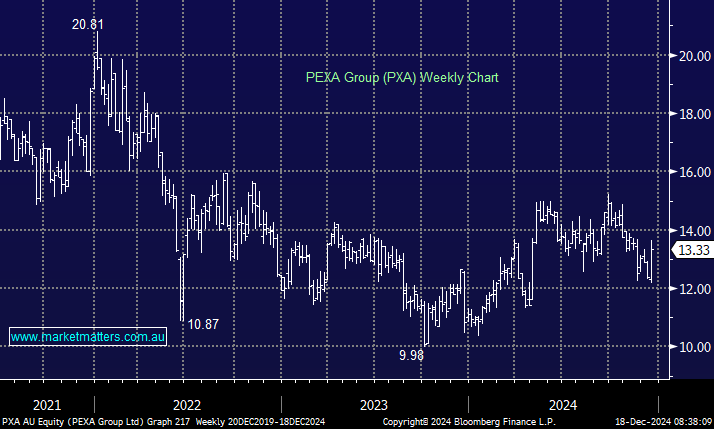

- PXA is a great solution, that we think is now on the cusp of turning into a great business. Earnings are set to grow strongly in the coming years, yet the share price is down from the IPO in 2021 and has tracked mildly lower in the past year.

The crux of their issues has been the complexity associated with aligning all stakeholders, bedding down complex systems and scaling operations into other jurisdictions, such as the UK. This is a very difficult area, and it’s taken longer and cost more than expected. While the Australian business has performed pretty well, the UK has been more of a struggle.

When they released FY24 results in August, they also announced the resignation of the CEO, and guided revenue growth in FY25 of 13-19%, which was a little light on given the market was already at the top end (19%). Yesterday, they announced a very strong CEO to take over on the 31st of March 2025. Russell Cohen is currently the Group Managing Director of Operations at a very successful multinational technology company called Grab, leading a team of 3000 across seven countries. He is highly rated, and yesterday’s market reaction (stock +8%) provides some insight into the markets interpretation of this appointment.

In FY25, we expect revenue to increase another ~16% to $400m underpinning an improvement in earnings and as the business scales further, we think earnings growth can compound annually at over 20%, making it an attractive growth stock for those with some patience.

- We view a price around $13.30 as a great entry point into a multiple-year growth story, underpinned by a structural shift towards digitisation.