PXA -11.79%: provided updated guidance ahead of their acquisition of Smoove acquisition in the UK which will complete tonight. Cost control has been solid, helping the company stick to EBITDA margin guidance of 35%, however, revenues have lagged expectations across the three business streams. Refinance activity dropped from 28% in Q1 to 22% in the first 2 months of Q2, overall transaction growth has been modest and market share lost in international has not been recovered which is expected to cause a 10-14% drop in revenue in the first half vs 2H23. Overall, the company expects Group EBITDA to be $54-58m in the first half, and $109-115m in the FY before taking into account the expected $4-6m drag from the acquisition.

scroll

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

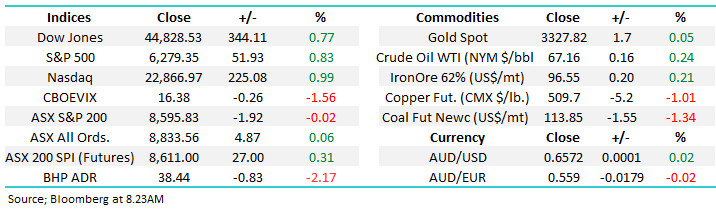

Friday 4th July – Dow up +344pts, SPI up +27pts

Friday 4th July – Dow up +344pts, SPI up +27pts

Close

Close

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Close

Close

Global X Battery Tech and Lithium ETF (ACDC)

Global X Battery Tech and Lithium ETF (ACDC)

Close

Close

MM remains long and bullish PXA

Add To Hit List

In these Portfolios

Related Q&A

What are MM’s current top 3 picks today from the Emerging Companies portfolio?

Your view on 3 stocks plus some graphene ideas

Does MM like PEXA Group?

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Friday 4th July – Dow up +344pts, SPI up +27pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Daily Podcast Direct from the Desk

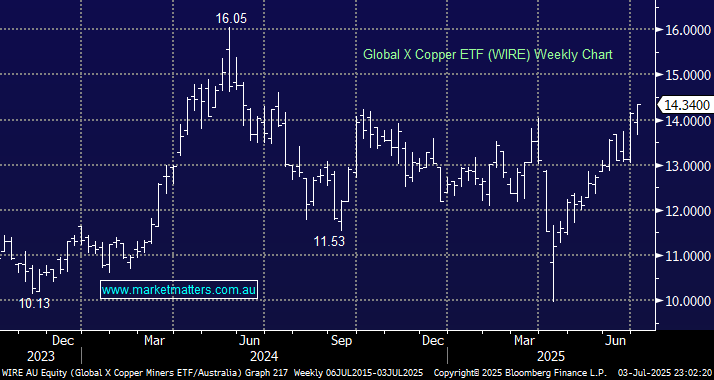

chart

Global X Battery Tech and Lithium ETF (ACDC)

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.