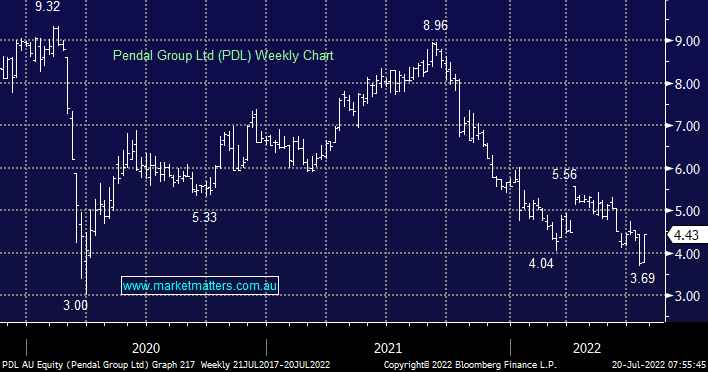

Our most recent purchase in the Income Portfolio seems to be once again in the sights of Perpetual (PPT) with the company going in and out of a trading half yesterday on rumours that PPT was back at the table. As a refresher, Pendal is the renamed BT Financial that was spun out of Westpac and back in April of this year, Perpetual launched a $2.4bn takeover attempt on their similar size rival only to be rebuffed by the PDL board on valuation grounds. At the time the deal was a mix of cash and shares valued at $6.23 which was a ~40% premium to where shares were trading before the bid. Since that bid, both stock prices have traded lower but PDL has fallen more.

As a base case, if we assume a deal on the same terms as before, that would imply +25% upside from yesterday’s close at a price of $5.52, however, given they rejected this premium before, that would be an admission by PDL that they got it wrong. Since then, PDL has experienced more outflows however at MM, we suspect an additional sweetener is still likely. Both companies have come out and downplayed the news, saying it’s highly conditional and no certainty of a deal at this stage, however, given this is now the 2nd attempt, we think this has legs.