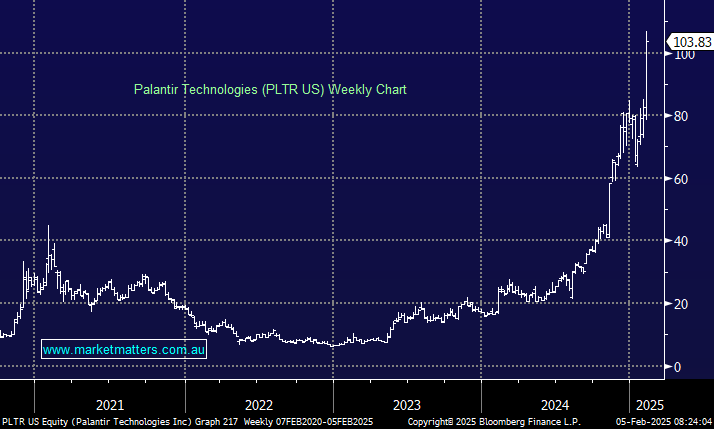

Palantir is a major provider of software and technology services to defence agencies. CEO Alex Karp attributed much of the company’s growth to its use of AI. Palantir shares popped 22% on strong fourth-quarter results which beat analyst expectations and forward outlook sending the stock surging to a fresh record high. Relative to expectations, the company shot the proverbial lights out:

- Revenue: $828 million vs. $776 million expected.

- Earnings per share: 14 cents adjusted vs. 11 cents expected.

Along with the fourth-quarter beat, Palantir offered better-than-expected guidance. The company said it expects revenue of between $858 million and $862 million, ahead of consensus of $799 million. The companies’ comments around the result left their opinion on the future for AI very clear: “Our business results continue to astound, demonstrating our deepening position at the centre of the AI revolution,” CEO Karp said.

- It’s easy to think the stocks gone too far but with its U.S. commercial revenue growing at 64%, the advance isn’t too scary.