Infrastructure can be a very worthwhile area of the market for income-focused investors, and MM’s Income Portfolio has exposure in this space. There are a few key reasons for this;

- Generally stable customer demand often as a provider of essential services.

- High barriers to entry, usually because of a high amount of capital required for physical assets and the long-term contracts or regulations involved.

- Economic hedging, which is essentially how the pricing of a service works; for example, prices are often linked to CPI, or earnings are often countercyclical, i.e. they do well when the economy struggles.

The upside here is that stocks generally have a lower-than-average beta (i.e. less volatile), but, the cost of capital is influential because they generally borrow a lot to own assets, and their earnings are longer-term in nature. Higher interest rates are, therefore, a headwind.

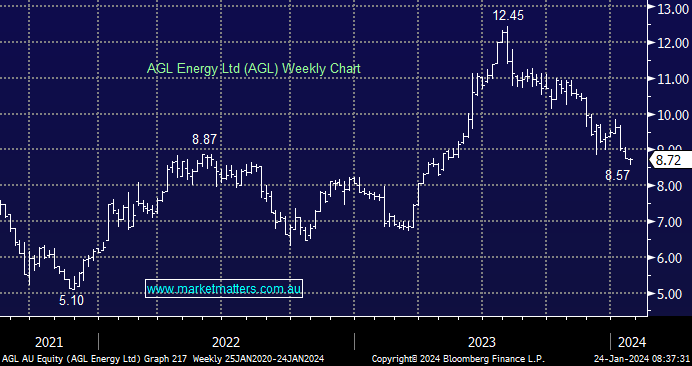

- When MM thinks about infrastructure we break it into two key areas. Pure play infrastructure stocks where the vast majority of earnings come from the infrastructure assets, examples include Transurban (TCL) and APA Group (APA), and Infrastructure Industrials which own some infrastructure but also have meaningful exposure to operating businesses, examples here include Telstra (TLS) and AGL Energy (AGL).

Subscribers will appreciate the extent to which interest rates/bond yields materially increased during 2023 and that provided a clear headwind for the bulk of these stocks. However, since the 30th October 23, bond yields have pulled back, particularly at the long end of the curve (US 10-year yields peaked at 5%, this morning, they are trading at 4.13%, having been as low as 3.8% at the end of December) – this macro trend is incredibly important for this sector. If MM is correct and yields track lower in 2024, the headwind that played out last year will become a tailwind this year. At the same time, inflation looks set to remain somewhat sticky, which is important when thinking about pricing mechanisms that are linked to CPI, in other words, they have a clear advantage in maintaining pricing power. There is also the prospect of more deal flow if funding pressures ease.

- We like a combination of pure infrastructure and infrastructure industrials into 2024, particularly for income focussed / defensive portfolios, with all three stocks we currently own, namely AGL Energy (AGL), APA Group (APA) & Telstra (TLS) active buys at current levels.