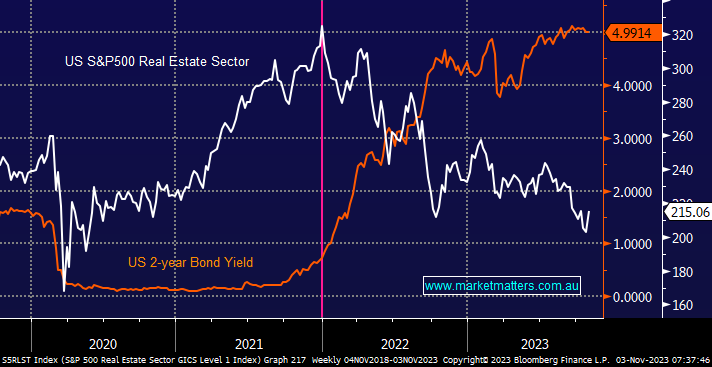

The Real Estate Sector has endured tough times of late, the local sector is down close to 5% in 2023, while the US equivalent has plunged over -38% from its early 2022 high, less than two years ago. Post-Covid, we’ve seen some tremendous returns from battered sectors when the dial finally turned with Tech, Coal and Gold all coming to mind, we believe the Property Sector could be throwing its hat into the proverbial ring as the next candidate.

- We like the risk/reward towards the property sector with a bounce towards +250, looking realistic or 15-20% higher.

The inverse correlation between bond yields and real estate is very clear: when yields rise real estate falls, and vice versa. If rates have finished rising, as we think they have, this creates an exciting prospect for the battered-up real estate names.

- We now like the risk/reward towards property following the ‘teak’ to the Fed’s rhetoric.