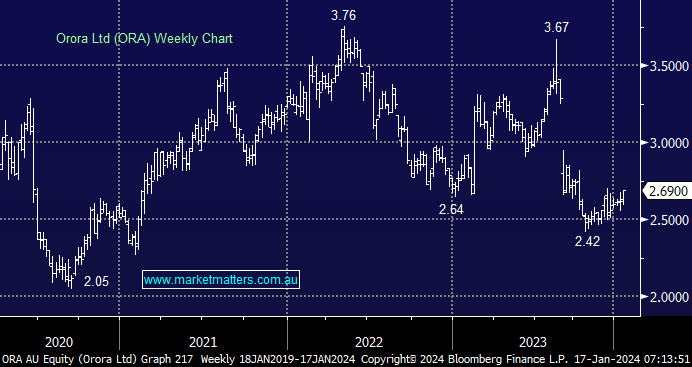

We added the packaging company ORA to the Income Portfolio in November and it’s showing a very small profit so far, and we continue to like the risk/reward on offer below $2.75. While income is at the core of this portfolio, we are also very conscious of populating the portfolio with more ‘defensive’ exposures to increase the consistency of returns and reduce downside capture; in other words, ‘alpha’ is added by capturing less of any prevailing weakness in the market.

At a high level, packaging stocks typically outperform in periods of falling inflation and slowing growth, as investors are attracted to defensive earnings growth and solid yields, and 2024, we think, will be one of those years. Hindsight is a wonderful thing, and when we consider the timing of their large acquisition of Saverglass in 2023, it was not ideal, with a large equity raise weighing on the shares at a time when global spirit/wine volumes have been soft. However, markets are forward-looking and in our view, this will be a low/trough in ORA earnings which we believe will improve into 2H24 with a path to double-digit earnings growth available.

- On an Est PE of 13.25x, a likely yield of 6% (unfranked) with defensive earnings that we think can grow at low double digits in the coming years, ORA is a preferred buy at current levels.