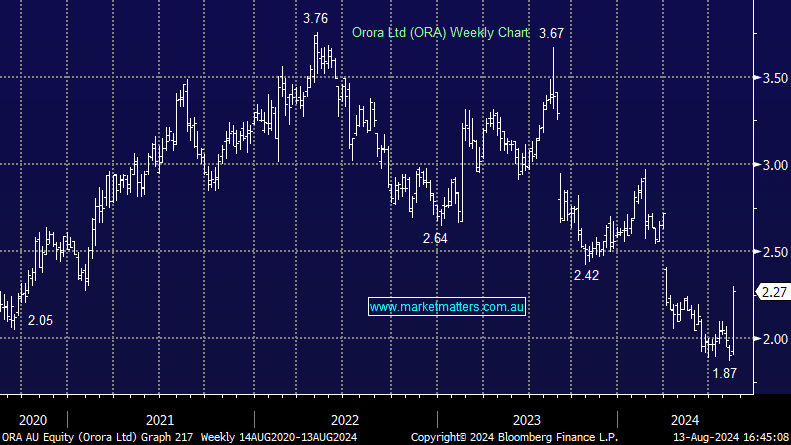

ORA +19.16%: Rallied nicely today on news of an informal bid from American private equity firm Lone Star at $2.55/sh, which was a 34% premium to yesterdays close. The bid is interesting and we doubt that it will be one and done in this instance. Lone Star is a $US92 billion PE firm which specialises in distressed debt, so if they were successful, they would look to break up the business and realise value in parts. Interestingly, Long Star were also trying to buy France’s Saverglass last year, only to be outbid by ORA. Since then, ORA’s share price has tanked, making the deal an attractive one. Lone Star clearly has the financial capacity and has done the work on Saverglass already.

- We owned ORA earlier in the year, selling for a loss around current prices. Ultimately, we think it’s unlikely this is a ‘one and done’ sort of approach, and there is a high chance that more will play out on this.