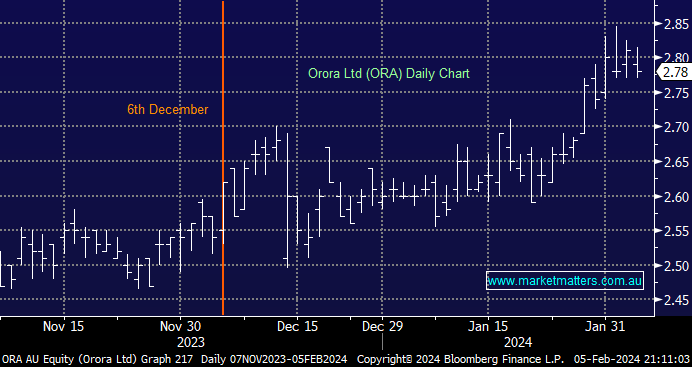

We remain bullish on the packaging business ORA, having increased our exposure last week, believing the stock is cheap after dropping over 30% after raising cash to fund an acquisition of Saverglass. Orora (ORA) dovetails nicely into MM’s outlook for the coming quarters, offering some defensive exposure through 2024 from earnings that can steadily in the coming years while delivering a yield of ~6% (unfranked).

- We remain bullish on ORA, having recently purchased it for our Active Growth Portfolio while it still resides in our Active Income Portfolio.