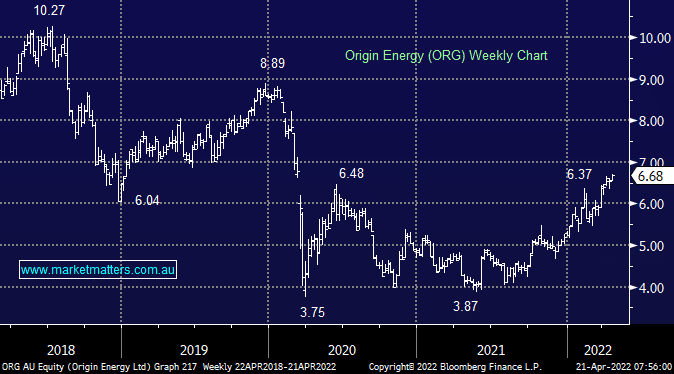

Both ORG & AGL Energy have enjoyed a strong rebound in their respective share prices over the past 12 months, ORG running from below $4 to ~$6.50 while AGL has advanced by a greater margin. At their March investor day, ORG announced a $250m on-market buy-back which commenced this month with more likely to follow, they also announced a strategic change to their operations which broadly speaking covered lowering their cost base, expanding products (internet via Aussie Broadband an example of this) and accelerating renewables & clean energy which combined with investments in batteries creates a big change in emissions. This is a stock turning around and on a projected P/E of 14.5x if they get it right they can experience the double whammy of higher earnings and a re-rate of the multiple the market is prepared to pay for those earnings.

scroll

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM is neutral ORG ~$6.60, preferring to buy into a pullback

Add To Hit List

Related Q&A

Origin Energy (ORG)

TNT or ORG – which one to sell?

Are AGL & ORG in a death spiral?

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.