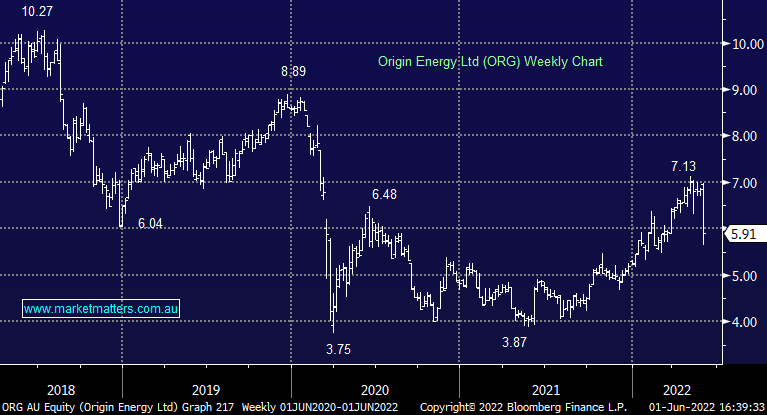

ORG -13.72%: higher energy prices have helped support Origin in recent months but today a coal shortage has forced the company to walk from FY23 guidance. The company said it was receiving less than contracted volumes of coal from Centennial to its Eraring power plant which had forced them into buying energy on the spot market at significantly higher rates than anticipated. While they maintained FY22 guidance, a larger portion of EBITDA will come from their Integrated Gas segment while Energy Markets is expected to contribute just $310-460m to EBITDA, down around 25% at the midpoint. They have also walked from premature FY23 guidance which had the Energy Markets business contributing $600-850m to EBITDA with coal supply concerns expected to continue.

scroll

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

Related Q&A

Origin Energy (ORG)

TNT or ORG – which one to sell?

Are AGL & ORG in a death spiral?

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.