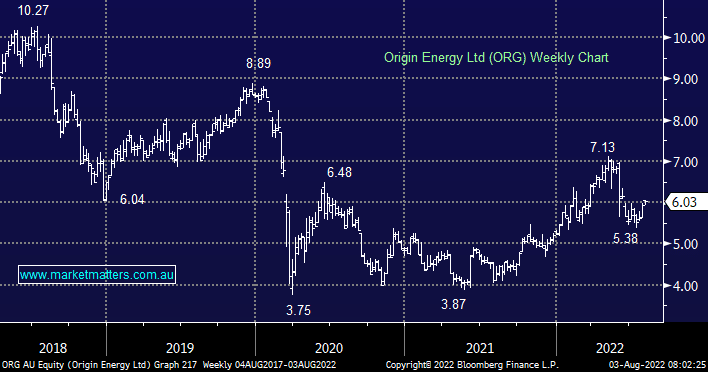

Integrated energy business ORG like most defensives has enjoyed 2022 rallying over +15% in a falling market. The stocks embraced a few factors in it’s favour but it’s not all been one-way traffic apart from the obvious migration down the risk curve by investors:

- In March the company announced a $250mn buyback plus they intend to accelerate their move towards renewables and clean energy – potentially broadening its appeal to many mandated fund managers.

- Energy prices helped support ORG through the first half of the year but the stocks followed crude lower over recent months i.e. it’s corrected ~25%.

- Coal shortages have weighed on the business forcing them to buy energy on the spot market at higher prices than expected damaging margins in the process.

- Just the mixed influences from oil and coal prices has made accurate forward guidance almost impossible hence the company withdrew its FY23 forecasts.

A combined position in ORG and Whitehaven Coal (WHC) in hindsight would have been perfect through 2022 as headwinds from coal would have been more than offset by gains in WHC. MM believes ORG is a turnaround stock that is offering good value into ongoing weakness but it feels capable of a deeper correction if the crude oil – coal elastic band stretches further, previously we said that we liked ORG under $6.50, but we have tweaked this slightly calling the stock an accumulate into weakness i.e. leave some ammunition to average if we see another test of $5 – it’s on our Hitlist but unlikely to be purchased in the coming weeks.