ORI +0.85%: edged higher today following solid 1H23 results and decent guidance for the 2H. For the half, sales were up 22% to $4bn which was about ~20% above consensus and that dropped down to underlying net profit after tax (NPAT) of $164m, up 27% and around 6% above consensus expectations with increased interest expense having an obvious negative influence. The interim dividend of 18cps unfranked was also above 16cps expected. Their outlook, while it appears conservative, still points to single-digit consensus earnings upgrades to flow through, and speaks to a more positive story around demand for explosives despite higher prices.

scroll

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

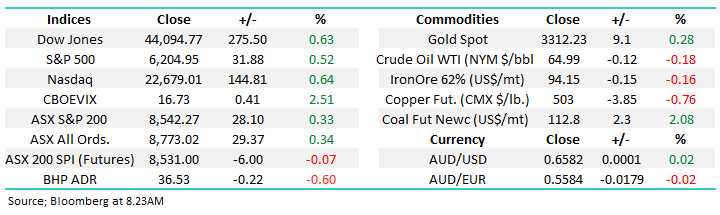

Tuesday 1st July 2025 – Dow +275pts, SPI down -6pts

Tuesday 1st July 2025 – Dow +275pts, SPI down -6pts

Close

Close

Monday 30th June – Dow up +432pts, SPI up +5pts

Monday 30th June – Dow up +432pts, SPI up +5pts

Close

Close

MM is neutral/bullish ORI

Add To Hit List

Related Q&A

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Tuesday 1st July 2025 – Dow +275pts, SPI down -6pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Monday 30th June – Dow up +432pts, SPI up +5pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.