After the market closed this morning, Nvidia delivered some concerning news to investors, with the stock falling ~6% after the company said it would record a $5.5bn charge tied to exporting H20 graphics processing units to China, among other destinations. Sentiment was also hurt by news that the U.S. Government recently informed the company that it would need a licence to export to China that accounts for ~14% of the chip maker’s revenue. The filing is the strongest indication thus far that Nvidia’s overall growth could be squeezed by increasing export restrictions on its chips.

- The US government informed Nvidia on Monday that the H20 would require a license to export to China “for the indefinite future”.

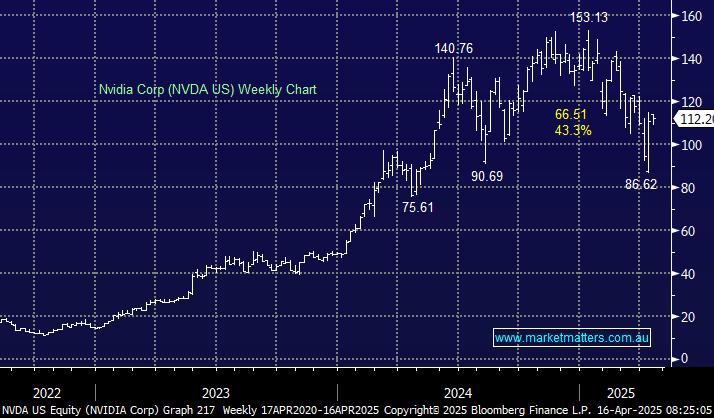

It’s not great news for Nvidia, but the business remains a cash cow which has been hit hard on tariff concerns. We have discussed NVDA, a $US2,700 billion goliath, several times over the last 12 months, a period in which it has often driven sentiment toward the whole US market. Importantly, it’s no longer being priced for significant growth, and some recent news even smells of contraction! China has already hurt NVDA’s share price after announcements around DeepSeek raised concerns about AI demand; this will be compounded if they cannot sell into China. However, we should remember In the first quarter of the fiscal year 2025 (Dec. 31 2024, reported Jan. 26 2025), NVDA reported an NPAT of $US22.1 billion, an almost 80% increase compared to the same quarter the previous year.

- We like the risk/reward towards NVDA below $US100, believing the negative news flow is peaking – note it’s a volatile beast!