Westpac launched a new Hybrid on Monday to replace an existing security due to be called in July of 2024 (WBCPI). The new money book closed early due to demand and on the last book update, they had ~$3.4bn worth of bids for both new money and the reinvestment of the existing (WBCPI). They initially said they would raise $750m which is the usual line, however, we suspect they will print north of $1.5bn, given the existing WBCPI has $1.4bn on issue – they may even hit the ~$2bn mark, it seems they were keen for the capital paying a generous margin and jumping other looming issues that were due before theirs.

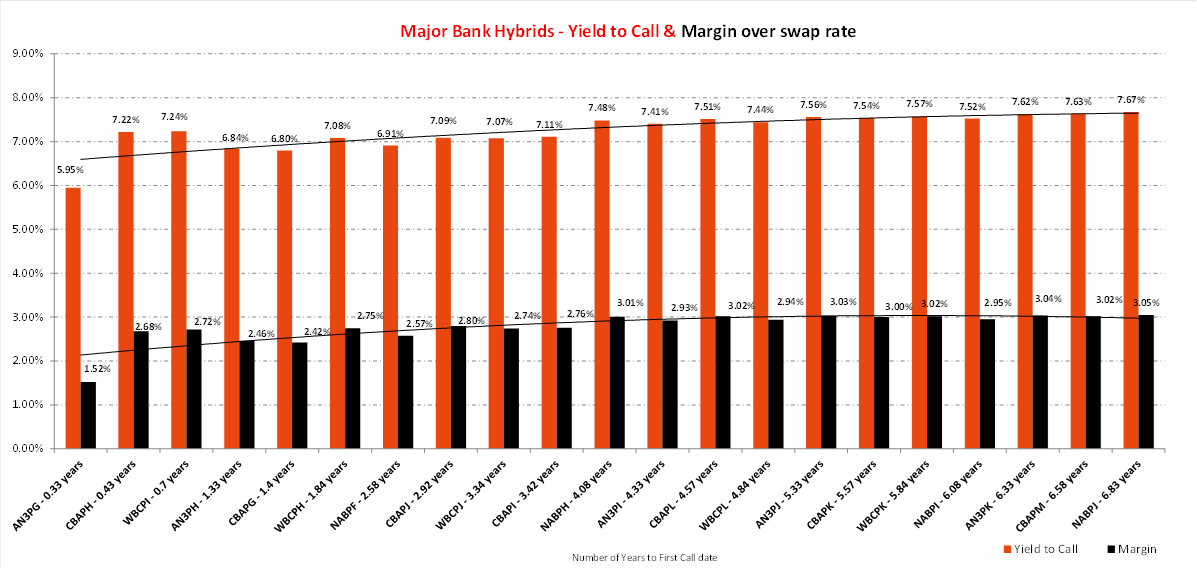

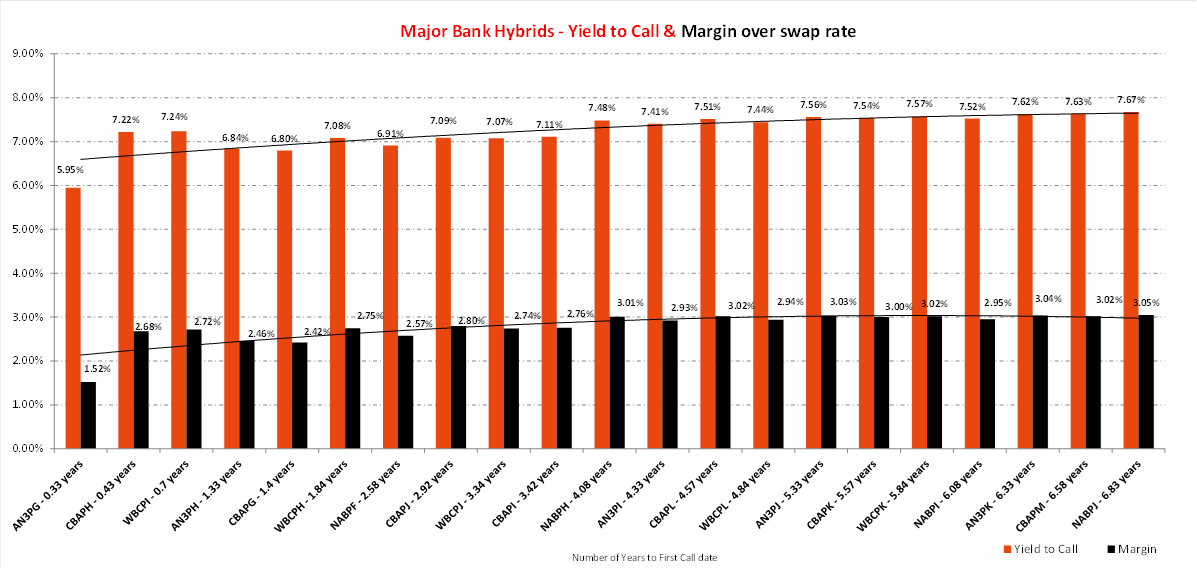

The margin will be priced at the lower end of the 3.10% to 3.30% range, adding on the bank bill rate gets a return grossed for franking of 7.49% using 90-day bills, but more if we apply the curve for the duration of the security, which is 7.75 years. Existing securities as shown in the chart below had margins of ~2.95% when the WBC was announced, increasing to ~3% now. That means WBC was rightly paying 10-15bps in new issue ‘fat’ which we expect, but some offers have not done this in recent times (CBA a recent example).

This security will more likely than not be the last for 2023, however, ANZ and CBA have existing issues due for first call in early 24, and we would expect both to launch new offers in January/February.

- We are positive on the new Westpac Hybrid, viewing it as attractively priced.