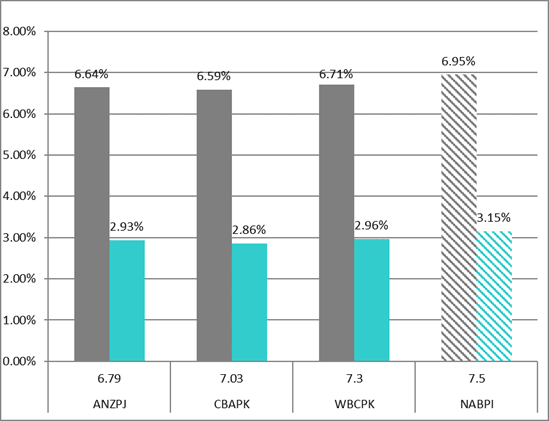

This week NAB launched a new hybrid offer to refinance an existing note being the NABPD. The new note is the NAB Capital Notes 6 and will trade under code NABPI. They say they will raise $1bn with the opportunity to do more or less with the guided range of 3.15%-3.35% over the 90-day bank bill rate. At the lower end, this equates to 6.95% grossed for franking. Importantly, when quoting such a yield this takes into consideration the expectations of the market around interest rates for the life of the hybrid.

As this is a rollover of an existing note, there is a reinvestment component where holders will receive a full allocation. The NABPD had an issue size of $1.5bn and we suspect NAB will not increase the amount taken in the new note above that level, meaning that the opportunity for new money will be fairly low (expect large scale back for those participating).

The margin of 3.15% over bank bill is ~20bps above where the market was trading making this an attractive note while that also helps to explain some of the weakness amongst hybrids in the past week. We’ve also seen credit spreads widen and interest rates rise. While Hybrids are floating and therefore provide a hedge against rate rises (and inflation), the margin as a percentage of the total return declines as rates go up, making them slightly less attractive in relative terms.

The chart below looks at comparable securities (already listed) versus the new NAB note.