There has been a flurry of new issuance across the Hybrid market in recent months, starting with Westpac at the end of 2023, ANZ first off the mark in 2024, followed by Bendigo & Adelaide Bank & IAG more recently. All are typical Tier 1 hybrid securities with the usual conditions, something we wrote about here. Below, we’ve provided an overview of each.

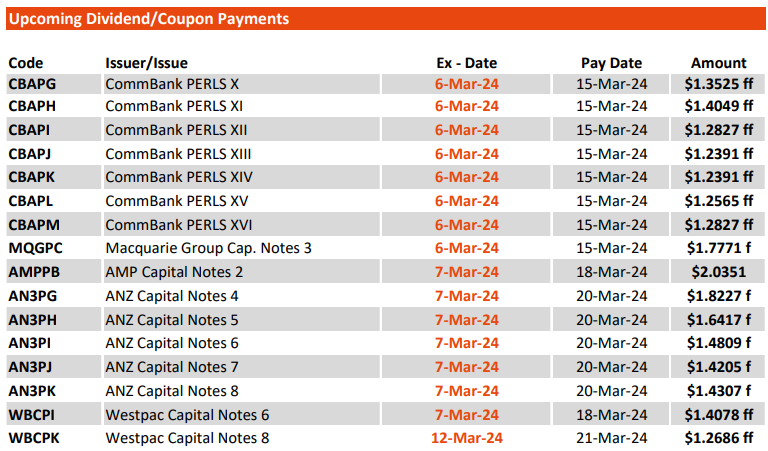

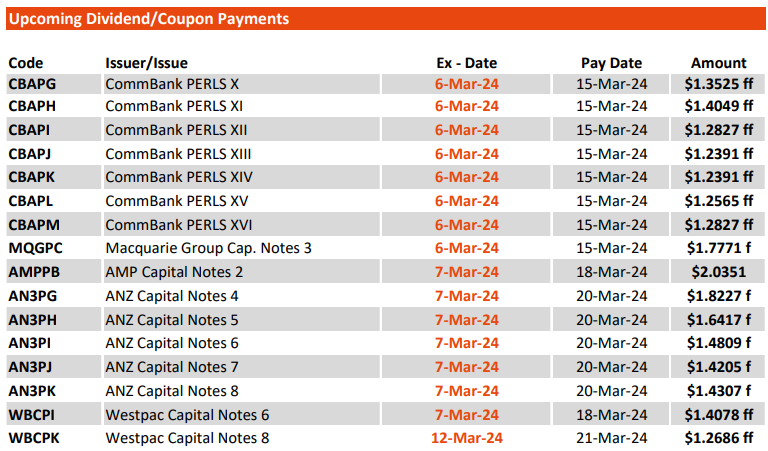

Westpac Capital Notes 10 (WBCPM): Launched 20th November 23 and was the best issue of the lot, in MM’s view, with WBC jumping the gun and paying a solid margin of 3.1% over the 90-day bank bill rate for a 7.7-year duration. At the time of issue, WBC gave investors around 0.10% new issue ‘fat’ to compensate for buying a new security, which is the sort of margin we like to see. This security now trades on a margin of 2.88% over BBSW and a price of $102.85, although it goes ex-distribution on the 13th of March and has $1.12 accrued in the price (implying a clean price of $101.73). For those looking for income, Hybrids have a knack for holding up better than their distribution amount, with a list of upcoming distributions provided below.

ANZ Capital Notes 4 (AN3PG): Launched 14th February and was our least preferred issue from the four, priced at 2.9% over the 90-day bank bill rate, putting it on a yield of ~7.2% grossed for franking, which was in line with current market pricing. This starts trading on the ASX on the 22nd of March, and if the market stays as-is, it will open very close to $100. Our view at the time was a 3% margin would have been a fairer outcome for investors. Demand was very high in this security, the highest across all four from what we saw.

Bendigo & Adelaide Bank Capital Notes 2 (BENPL): Launched 26th February and was offered at a 0.30% per annum higher margin than the recent ANZ Hybrid. While regional banks trade wider than major banks, Bendigo is a conservatively run bank and, in our view, has better credit than the Bank of QLD (BOQ). At a margin of 3.20% over the 90-day bank bill rate, the BENPL was on a running yield of 7.54% (yield to call 7.3%), which is more favourable than anything else in the market, Challenger Group (CGFPD), for instance, trades at 3% over, and we would prefer BEN as an issuer. A good Hybrid that should trade above $100 when it starts trading on the 26th of March.

IAG Capital Notes 3 (IAGPF): Launched 3rd March and was offered at the same 3.2% margin as the Bendigo note, however, it was open to new money only, with IAG looking to raise ~$300m with the ability to take more or less. There is only one existing IAG note on issue (IAGPE), which creates some scarcity. The existing IAGPE is on issue with 5.3 years to run trades on a margin of 2.94%, so with the added duration, we think this was a fair margin. The note starts trading on the ASX on 27th March and should open mildly above par.

- Ultimately, the WBCPM was most attractive, followed closely by the BENPL & IAGPF, with the ANZPG least preferred from a relative sense, although it’s still a solid security, and this view is based on relative pricing only.

The Commonwealth Bank has the CBAPH due to be called on the 26th of April, and we expect CBA to launch a new note shortly.