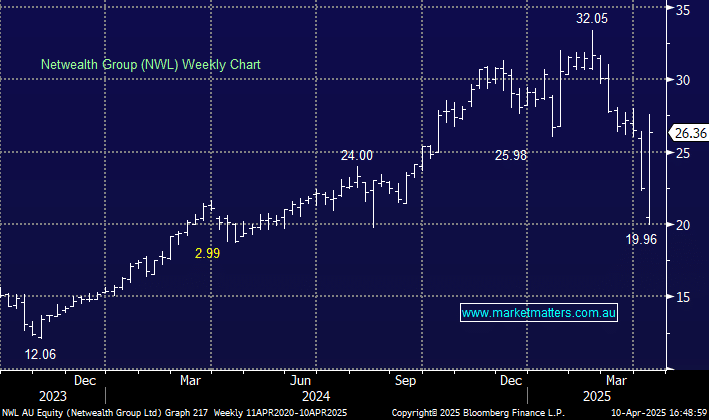

NWL +16.59%: Released a solid quarterly update this morning on a day where high-beta technology stocks were already due to outperform. Funds under administration inflows took a slight dip but maintained positive momentum, though slightly offset by mention of higher FY26 costs.

- Funds under administration (FUA) at 31 March $104.08 billion, +2.5% qoq

- Quarterly FUA net inflows $3.5bn, -22% qoq

- Funds under management (FUM) at period end $24.76bn, +3.1% qoq

- Member accounts 155,738, +2.8% qoq

Flow momentum has continued into April and cash balances is also increasing which is positive for revenue. The one negative from today’s update is potential for higher costs in FY26e expected to be ~5% higher, predominantly due to increased headcount 1H25 vs 2H25, though this is expense is discretionary in nature and can be reduced if revenues weaken.