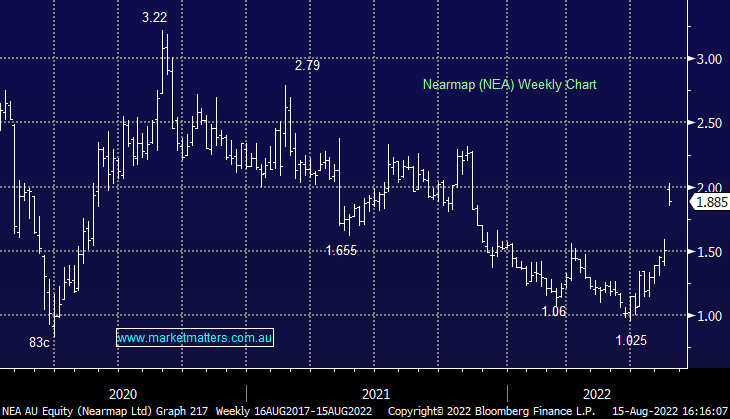

NEA +24.83%: the advanced mapping company revealed a takeover bid was in play from tech private equity fund Thoma Bravo. The US based $US100b fund put forward a $2.10/sh offer in early July, which was an 83% premium to the share price at the time. Shares have since rebounded, but the bid still represented a 39% premium to Friday’s close. Thoma Bravo will get first rights in the deal, currently working on exclusive due diligence to firm up the price and any funding needs, though other potential bidders are rumoured to be circling. The company’s performance has also rebounded. Annualized Contract Value (ACV) is expected to come in at $159.9m for FY22, at the top end of guidance. Cash burn has also decreased with $93.7m of cash expected to be on the balance sheet at the end of the period, running through recently raised capital at a slower rate than expected. There was 6% of the register short sold as of late last week, short covering assisting the squeeze to a tight ~10% discount to the offer price today.

scroll

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM expects NEA to be taken over one way or another

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.