A month ago, we looked at the resources through the eye of some local ETFs and with the market largely unfolding as we expected, members have been asking us “what now” after the sector pushes higher. So far in 2025, the materials sector has surged +26% while tech -15% and healthcare -21% have struggled. However, we always must be cognisant that good things don’t last forever, and performance elastic bands often snap back as opposed to easing back to a fresh level of equilibrium. Just imagine holding a portfolio heavily weighted to tech and healthcare through 2025, it will have been an extremely tough year.

- The diverse performance across the ASX so far this year illustrates the benefits of being active investors like MM.

The outperformance by the materials sector is starting to look and feel mature but there are no signs that it’s time to dramatically restructure portfolios.

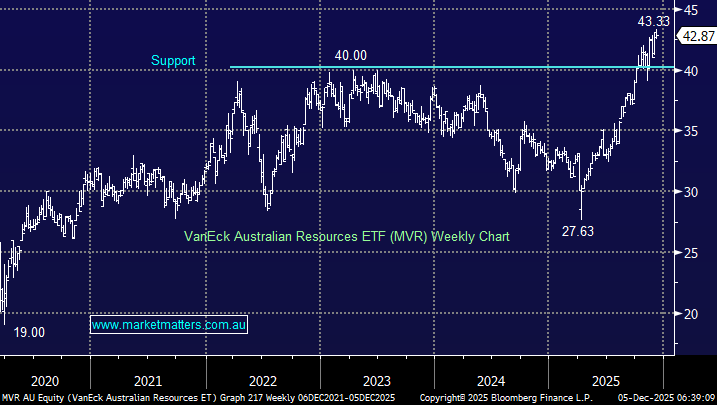

The broad-based local VanEck Australian Resources ETF (MVR) has surged +57% from its April low with the performance illustrating how sectors go in and out of favour as the economic landscape evolves. The resources stocks couldn’t catch a trick through 2023 and 2024 as the Chinese property market collapsed leading to reduced demand, prices, and sentiment. However, as global electrification takes centre stage, we’ve seen a resurgence led by copper and gold, but it has advanced a long way in a short time.

- The MVR ETF holds 33 stocks, with its 5 largest positions currently BHP, Woodside, Fortescue, RIO, and Northern Star.

- It has a decent $458mn market cap, while its fees are a very reasonable 0.35%.

The risk/reward is unappealing ~$43 and we would be more inclined to adopt a “wait and see” approach as the ETF trades around fresh highs – at this stage of the cycle MM prefers a more stock and sector specific approach as opposed to using a more scatter gun like strategy which the MVR ETF provides.