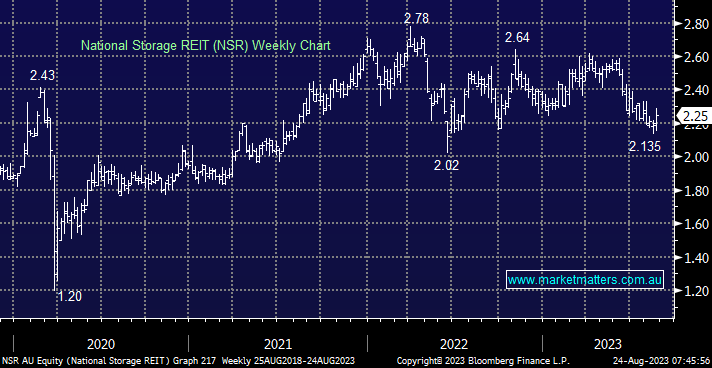

We see Fund Managers are very underweight REITs and we believe this is an area where value has emerged, although there are varying risk levels associated with different types of REITs. Storage assets in MM’s view are lower risk and the largest (and best) supplier of self-storage is National Storage with around 200 facilities in Australia & New Zealand. They reported FY23 results yesterday (discussed here) and their guidance for FY24 was solid. Importantly, they are trading at a 9.2% discount to their asset value, which is a very rare occurrence since NSR was listed in 2013.

- We like NSR believing it’s a quality operator that shouldn’t be trading 10% below its NTA.

- We recently bought NSR in our Flagship Growth Portfolio