The term ESG stands for Environmental, Social & Governance and is a set of standards of behaviour that socially conscious investors are now demanding from their investments. There are more investors building ESG into their process, which is a good thing, and companies are now investing more heavily here and making decisions through a more varied lens, i.e. not just a financial one. Statistics show a market that has rapidly grown to $US35 trillion, although it’s clear there are plenty of grey areas around this as some companies try to simply tick the ESG box rather than engrain it in their operations – imagine that, companies simply seeing just a financial opportunity in all of this!

That said, one of the resounding messages coming from company meetings in the last 12 months or so, particularly from companies in the ASX 200 is the huge importance of ESG, and the demands large institutional investors are placing on them to deliver. Like all things in the financial markets, there are $$ to be made from this area, whether that be through screening processes, ESG indices, ESG portfolios or specific ESG fund managers.

- At MM we are fans of ESG investing but only with correct risk/reward profiles at any given time and we do have a level of cynicism around it.

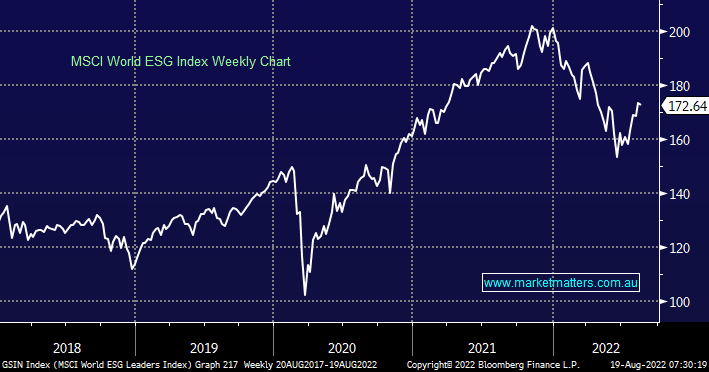

- The market has already whacked investors who adopted a “GAAP – growth at any price” attitude, we’re not advocates of chasing ESG stocks in a similar manner, the last 12 months has been a tough time for the sector.