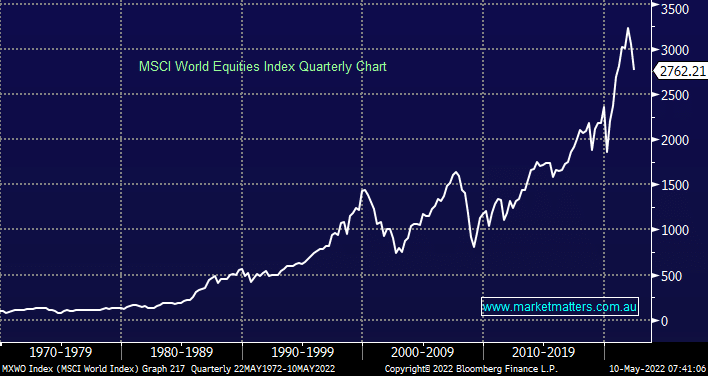

At MM we are believers in the global economy and by definition stocks, we only have to look at history to give us confidence in equities although of course, they do at times go down as well as up i.e. stocks move short-term on news and liquidity but it’s the underlying company performance that determines where a stock will be changing hands a few years down the track. A couple of very important points that MM wants to reiterate to nervous subscribers:

- Large corrections are historically great investment opportunities for those prepared to buy quality companies during periods of weakness.

- Holding large cash positions over time is a wealth destroyer, sounds dramatic but it’s true.

- However at MM, we aren’t averse to raising cash positions and looking for better opportunities in the months ahead i.e. adding alpha around the edges.

So far MM has moved our Growth Portfolios to a more defensive stance through purchases of stocks like Woolworths (WOW) and TPG Telecom (TPM) but we still hold some growth names that are struggling plus our cash levels are low. The questions we are pondering today:

- MM feels comfortable currently being skewed towards a more defensive stance than at the start of 2022, it’s paying dividends so far but should we go further?

- Secondly MM is pondering if we should lift our cash levels and by definition flexibility through 2022/23.