Last month, DeepSeek turned the AI world on its head by releasing a new, competitive simulated reasoning model that is free to download and use under an MIT licence. Now, the company is preparing to make the underlying code behind that model more accessible, promising to release five open-source repos starting this week. The news flow around AI feels like something out of a “Fast and Furious” movie. In the last few days, we’ve heard a plethora of news that can be interpreted in different ways.

- Apple announced that it is constructing a new AI server in Houston as part of its $US500bn spending on US infrastructure.

- Microsoft is reported to have cancelled some data centre leases. Perhaps they are looking to build their own and/or are waiting to see their requirements after the release of DeepSeek.

- Overnight, Alibaba announced plans to spend $US53bn on AI infrastructure, such as data centres, over the next three years. This is a significant pivot by the e-commerce giant as it strives to become a leader in AI.

- Nvidia (NVDA US) reports its much-anticipated results on Thursday morning, which is likely to set off fireworks across the AI and tech space.

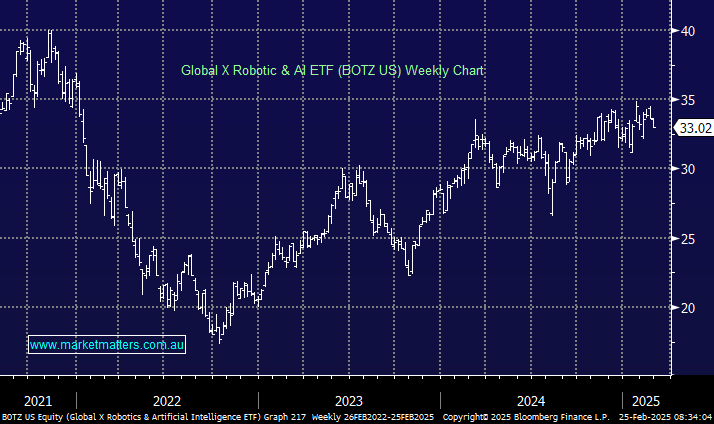

We are bullish on the AI theme over the coming years, but there will be distinct winners and losers on the stock level as the relatively new industry evolves. Volatility is even high in AI ETFs, with the $US2.8 bn US-listed BOTZ correcting more than 20% yearly over the last three years, illustrating huge swings in sentiment.

NB The five largest holdings in the BOTZ ETF are Nvidia, Intuitive Surgical, ABB, Keyence and Dynatrace.

- We like the BOTZ ETF into a pullback, back around $US30.

This morning, we quickly revisited Nvidia into its result and identified three US-traded China-based AI stocks we like over the coming year (s) as Xi Jinping attempts to improve relations with investors. The performance of Chinese stocks is currently almost like an arm wrestle between Trump and Beijing, with the latter winning so far in 2025.